Form St-R-21 - Exemption Application - An Incorporated Hospital

ADVERTISEMENT

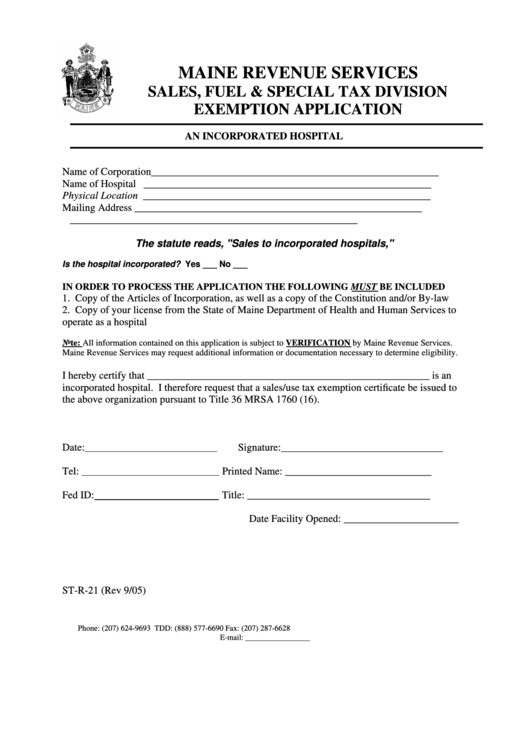

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

EXEMPTION APPLICATION

AN INCORPORATED HOSPITAL

Name of Corporation_______________________________________________________

Name of Hospital

_______________________________________________________

Physical Location

_______________________________________________________

Mailing Address

_______________________________________________________

_______________________________________________________

The statute reads, "Sales to incorporated hospitals,"

Is the hospital incorporated? Yes ___ No ___

IN ORDER TO PROCESS THE APPLICATION THE FOLLOWING MUST BE INCLUDED

1. Copy of the Articles of Incorporation, as well as a copy of the Constitution and/or By-law

2. Copy of your license from the State of Maine Department of Health and Human Services to

operate as a hospital

Note: All information contained on this application is subject to VERIFICATION by Maine Revenue Services.

Maine Revenue Services may request additional information or documentation necessary to determine eligibility.

I hereby certify that ______________________________________________________ is an

incorporated hospital. I therefore request that a sales/use tax exemption certificate be issued to

the above organization pursuant to Title 36 MRSA 1760 (16).

Date:

Signature:_______________________________

Tel:

Printed Name: ____________________________

Fed ID:

Title: ___________________________________

Date Facility Opened: ______________________

ST-R-21 (Rev 9/05)

Phone: (207) 624-9693

TDD: (888) 577-6690

Fax: (207) 287-6628

E-mail: salestax@maine.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1