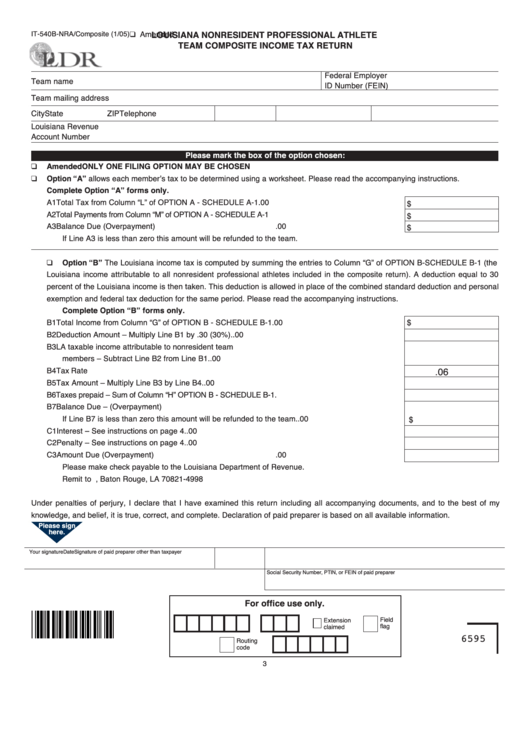

❑ Amended

IT-540B-NRA/Composite (1/05)

LOUISIANA NONRESIDENT PROFESSIONAL ATHLETE

TEAM COMPOSITE INCOME TAX RETURN

Federal Employer

Team name

ID Number (FEIN)

Team mailing address

City

State

ZIP

Telephone

Louisiana Revenue

Account Number

Please mark the box of the option chosen:

❑

Amended

ONLY ONE FILING OPTION MAY BE CHOSEN

❑

Option “A” allows each member’s tax to be determined using a worksheet. Please read the accompanying instructions.

Complete Option “A” forms only.

A1 Total Tax from Column “L” of OPTION A - SCHEDULE A-1

.................................................. A1

.00

$

A2 Total Payments from Column “M” of OPTION A - SCHEDULE A-1 .................................................. A2

.00

$

A3 Balance Due (Overpayment)

.................................................. A3

.00

$

If Line A3 is less than zero this amount will be refunded to the team.

❑

Option “B” The Louisiana income tax is computed by summing the entries to Column “G” of OPTION B-SCHEDULE B-1 (the

Louisiana income attributable to all nonresident professional athletes included in the composite return). A deduction equal to 30

percent of the Louisiana income is then taken. This deduction is allowed in place of the combined standard deduction and personal

exemption and federal tax deduction for the same period. Please read the accompanying instructions.

Complete Option “B” forms only.

B1 Total Income from Column “G” of OPTION B - SCHEDULE B-1 .................................................. B1

$

.00

B2 Deduction Amount – Multiply Line B1 by .30 (30%).

.................................................. B2

.00

B3 LA taxable income attributable to nonresident team

members – Subtract Line B2 from Line B1.

.................................................. B3

.00

B4 Tax Rate.

.................................................. B4

.00

.06

B5 Tax Amount – Multiply Line B3 by Line B4.

.................................................. B5

.00

B6 Taxes prepaid – Sum of Column “H” OPTION B - SCHEDULE B-1. ................................................ B6

.00

B7 Balance Due – (Overpayment)

If Line B7 is less than zero this amount will be refunded to the team. .......................................... B7

.00

$

C1 Interest – See instructions on page 4.

................................................. C1

.00

C2 Penalty – See instructions on page 4.

................................................. C2

.00

C3 Amount Due (Overpayment)

................................................. C3

.00

Please make check payable to the Louisiana Department of Revenue.

Remit to P.O. BOX 4998, Baton Rouge, LA 70821-4998

Under penalties of perjury, I declare that I have examined this return including all accompanying documents, and to the best of my

knowledge, and belief, it is true, correct, and complete. De claration of paid preparer is based on all available information.

Please sign

here.

Your signature

Date

Signature of paid preparer other than taxpayer

Social Security Number, PTIN, or FEIN of paid preparer

For office use only.

Field

Extension

flag

claimed

6595

Routing

code

3

1

1 2

2 3

3 4

4