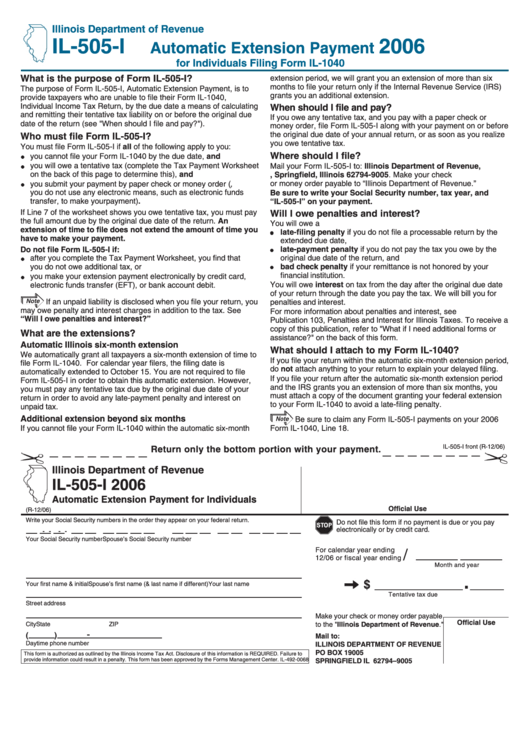

Form Il-505-I - Automatic Extension Payment For Individuals - 2006

ADVERTISEMENT

Illinois Department of Revenue

IL-505-I

2006

Automatic Extension Payment

for Individuals Filing Form IL-1040

What is the purpose of Form IL-505-I?

extension period, we will grant you an extension of more than six

months to file your return only if the Internal Revenue Service (IRS)

The purpose of Form IL-505-I, Automatic Extension Payment, is to

grants you an additional extension.

provide taxpayers who are unable to file their Form IL-1040,

Individual Income Tax Return, by the due date a means of calculating

When should I file and pay?

and remitting their tentative tax liability on or before the original due

If you owe any tentative tax, and you pay with a paper check or

date of the return (see "When should I file and pay?").

money order, file Form IL-505-I along with your payment on or before

the original due date of your annual return, or as soon as you realize

Who must file Form IL-505-I?

you owe tentative tax.

You must file Form IL-505-I if all of the following apply to you:

Where should I file?

you cannot file your Form IL-1040 by the due date, and

you will owe a tentative tax (complete the Tax Payment Worksheet

Mail your Form IL-505-I to: Illinois Department of Revenue,

on the back of this page to determine this), and

P.O. Box 19005, Springfield, Illinois 62794-9005. Make your check

or money order payable to “Illinois Department of Revenue.”

you submit your payment by paper check or money order ( i.e.,

you do not use any electronic means, such as electronic funds

Be sure to write your Social Security number, tax year, and

transfer, to make your payment).

“IL-505-I” on your payment.

If Line 7 of the worksheet shows you owe tentative tax, you must pay

Will I owe penalties and interest?

the full amount due by the original due date of the return. An

You will owe a

extension of time to file does not extend the amount of time you

late-filing penalty if you do not file a processable return by the

have to make your payment.

extended due date,

late-payment penalty if you do not pay the tax you owe by the

Do not file Form IL-505-I if:

after you complete the Tax Payment Worksheet, you find that

original due date of the return, and

bad check penalty if your remittance is not honored by your

you do not owe additional tax, or

financial institution.

you make your extension payment electronically by credit card,

electronic funds transfer (EFT), or bank account debit.

You will owe interest on tax from the day after the original due date

of your return through the date you pay the tax. We will bill you for

If an unpaid liability is disclosed when you file your return, you

penalties and interest.

may owe penalty and interest charges in addition to the tax. See

For more information about penalties and interest, see

“Will I owe penalties and interest?”

Publication 103, Penalties and Interest for Illinois Taxes. To receive a

copy of this publication, refer to "What if I need additional forms or

What are the extensions?

assistance?" on the back of this form.

Automatic Illinois six-month extension

What should I attach to my Form IL-1040?

We automatically grant all taxpayers a six-month extension of time to

If you file your return within the automatic six-month extension period,

file Form IL-1040. For calendar year filers, the filing date is

do not attach anything to your return to explain your delayed filing.

automatically extended to October 15. You are not required to file

If you file your return after the automatic six-month extension period

Form IL-505-I in order to obtain this automatic extension. However,

and the IRS grants you an extension of more than six months, you

you must pay any tentative tax due by the original due date of your

must attach a copy of the document granting your federal extension

return in order to avoid any late-payment penalty and interest on

to your Form IL-1040 to avoid a late-filing penalty.

unpaid tax.

Additional extension beyond six months

Be sure to claim any Form IL-505-I payments on your 2006

If you cannot file your Form IL-1040 within the automatic six-month

Form IL-1040, Line 18.

IL-505-I front (R-12/06)

Return only the bottom portion with your payment.

Illinois Department of Revenue

IL-505-I 2006

Automatic Extension Payment for Individuals

Official Use

(R-12/06)

Write your Social Security numbers in the order they appear on your federal return.

Do not file this form if no payment is due or you pay

electronically or by credit card.

-

-

-

-

Your Social Security number

Spouse’s Social Security number

For calendar year ending

/

12/06 or fiscal year ending

Month and year

.

$ _____________

_____

Your first name & initial

Spouse’s first name (& last name if different)

Your last name

Tentative tax due

Street address

Make your check or money order payable

Official Use

City

State

ZIP

to the "Illinois Department of Revenue."

-

(

)

Mail to:

Daytime phone number

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19005

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-0068

SPRINGFIELD IL 62794–9005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1