Instructions For Form St-809 - New York State And Local Sales And Use Tax Return For Part-Quarterly Filers

ADVERTISEMENT

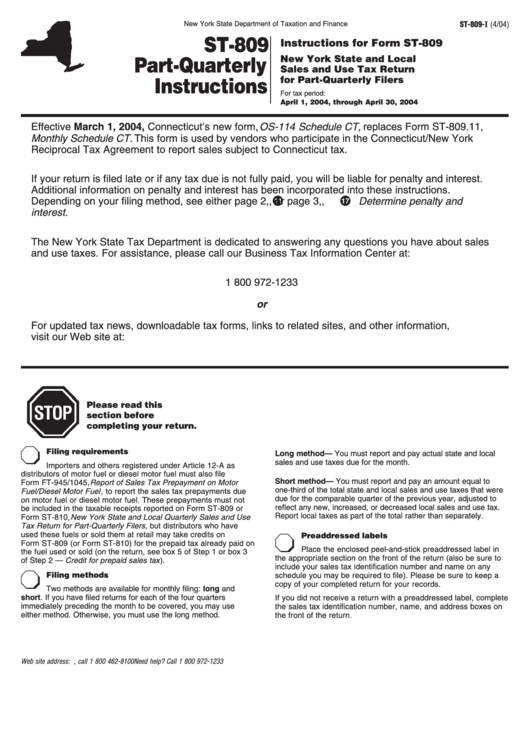

New York State Department of Taxation and Finance

ST-809-

I

(4/04)

ST-809

Instructions for Form ST-809

New York State and Local

Part-Quarterly

Sales and Use Tax Return

for Part-Quarterly Filers

Instructions

For tax period:

April 1, 2004, through April 30, 2004

Effective March 1, 2004, Connecticut’s new form, OS-114 Schedule CT, replaces Form ST-809.11,

Monthly Schedule CT. This form is used by vendors who participate in the Connecticut/New York

Reciprocal Tax Agreement to report sales subject to Connecticut tax.

If your return is filed late or if any tax due is not fully paid, you will be liable for penalty and interest.

Additional information on penalty and interest has been incorporated into these instructions.

, Determine penalty and

Depending on your filing method, see either page 2,

, or page 3,

interest.

The New York State Tax Department is dedicated to answering any questions you have about sales

and use taxes. For assistance, please call our Business Tax Information Center at:

1 800 972-1233

or

For updated tax news, downloadable tax forms, links to related sites, and other information,

visit our Web site at:

Please read this

section before

completing your return.

Filing requirements

Long method — You must report and pay actual state and local

sales and use taxes due for the month.

Importers and others registered under Article 12-A as

distributors of motor fuel or diesel motor fuel must also file

Short method — You must report and pay an amount equal to

Form FT-945/1045, Report of Sales Tax Prepayment on Motor

one-third of the total state and local sales and use taxes that were

Fuel/Diesel Motor Fuel , to report the sales tax prepayments due

due for the comparable quarter of the previous year, adjusted to

on motor fuel or diesel motor fuel. These prepayments must not

reflect any new, increased, or decreased local sales and use tax.

be included in the taxable receipts reported on Form ST-809 or

Report local taxes as part of the total rather than separately.

Form ST-810, New York State and Local Quarterly Sales and Use

Tax Return for Part-Quarterly Filers, but distributors who have

used these fuels or sold them at retail may take credits on

Preaddressed labels

Form ST-809 (or Form ST-810) for the prepaid tax already paid on

Place the enclosed peel-and-stick preaddressed label in

the fuel used or sold (on the return, see box 5 of Step 1 or box 3

the appropriate section on the front of the return (also be sure to

of Step 2 — Credit for prepaid sales tax ).

include your sales tax identification number and name on any

Filing methods

schedule you may be required to file). Please be sure to keep a

copy of your completed return for your records.

Two methods are available for monthly filing: long and

short. If you have filed returns for each of the four quarters

If you did not receive a return with a preaddressed label, complete

immediately preceding the month to be covered, you may use

the sales tax identification number, name, and address boxes on

either method. Otherwise, you must use the long method.

the front of the return.

Web site address:

To order forms, call 1 800 462-8100

Need help? Call 1 800 972-1233

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4