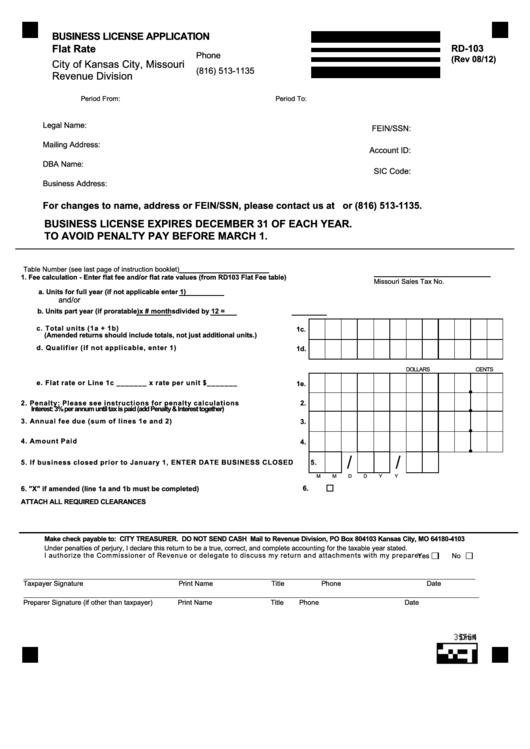

BUSINESS LICENSE APPLICATION

Flat Rate

RD-103

Phone

(Rev 08/12)

City of Kansas City, Missouri

(816) 513-1135

Revenue Division

Period From:

Period To:

Legal Name:

FEIN/SSN:

Mailing Address:

Account ID:

DBA Name:

SIC Code:

Business Address:

For changes to name, address or FEIN/SSN, please contact us at or (816) 513-1135.

BUSINESS LICENSE EXPIRES DECEMBER 31 OF EACH YEAR.

TO AVOID PENALTY PAY BEFORE MARCH 1.

Table Number (see last page of instruction booklet)

1. Fee calculation - Enter flat fee and/or flat rate values (from RD103 Flat Fee table)

Missouri Sales Tax No.

a. Units for full year (if not applicable enter 1)

and/or

b. Units part year (if proratable)

x # months

divided by 12 =

c. Total units (1a + 1b)

1c.

(Amended returns should include totals, not just additional units.)

d. Qualifier (if not applicable, enter 1)

1d.

DOLLARS

CENTS

e. Flat rate or Line 1c _______ x rate per unit $_______

1e.

2. Penalty: Please see instructions for penalty calculations

2.

Interest: 3% per annum until tax is paid (add Penalty & Interest together)

3. Annual fee due (sum of lines 1e and 2)

3.

4. Amount Paid

4.

/

/

5. If business closed prior to January 1, ENTER DATE BUSINESS CLOSED

5.

M

M

D

D

Y

Y

6.

6. "X" if amended (line 1a and 1b must be completed)

ATTACH ALL REQUIRED CLEARANCES

Make check payable to: CITY TREASURER. DO NOT SEND CASH Mail to Revenue Division, PO Box 804103 Kansas City, MO 64180-4103

Under penalties of perjury, I declare this return to be a true, correct, and complete accounting for the taxable year stated.

I authorize the Comm issioner of Revenue or delegate to discuss m y return and attachments with m y preparer.

Yes

No

Taxpayer Signature

Print Name

Title

Phone

Date

Preparer Signature (if other than taxpayer)

Print Name

Title

Phone

Date

Draft

1

1