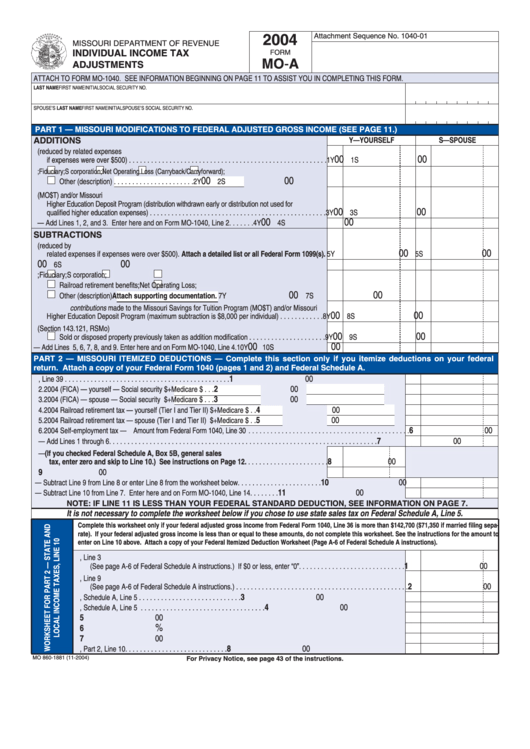

Form Mo-A - Individual Income Tax Adjustments - 2004

ADVERTISEMENT

Attachment Sequence No. 1040-01

2004

MISSOURI DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX

FORM

MO-A

ADJUSTMENTS

ATTACH TO FORM MO-1040. SEE INFORMATION BEGINNING ON PAGE 11 TO ASSIST YOU IN COMPLETING THIS FORM.

LAST NAME

FIRST NAME

INITIAL

SOCIAL SECURITY NO.

SPOUSE’S LAST NAME

FIRST NAME

INITIAL

SPOUSE’S SOCIAL SECURITY NO.

PART 1 — MISSOURI MODIFICATIONS TO FEDERAL ADJUSTED GROSS INCOME (SEE PAGE 11.)

ADDITIONS

Y—YOURSELF

S—SPOUSE

1. Interest on state and local obligations other than Missouri source (reduced by related expenses

00

00

if expenses were over $500) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1Y

1S

2.

Partnership;

Fiduciary;

S corporation;

Net Operating Loss (Carryback/Carryforward);

00

00

Other (description)

. . . . . . . . . . . . . . . . . . . . . .

2Y

2S

3. Nonqualified distribution received from Missouri Savings for Tuition Program (MO$T) and/or Missouri

Higher Education Deposit Program (distribution withdrawn early or distribution not used for

00

00

qualified higher education expenses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3Y

3S

00

00

4. TOTAL ADDITIONS — Add Lines 1, 2, and 3. Enter here and on Form MO-1040, Line 2. . . . . . .

4Y

4S

SUBTRACTIONS

5. Interest from exempt federal obligations included in federal adjusted gross income (reduced by

00

00

related expenses if expenses were over $500). Attach a detailed list or all Federal Form 1099(s). 5Y

5S

00

00

6. Any state income tax refund included in federal adjusted gross income . . . . . . . . . . . . . . . . . . . . .

6Y

6S

7.

Partnership;

Fiduciary;

S corporation;

Railroad retirement benefits;

Net Operating Loss;

00

00

Other (description)

Attach supporting documentation. 7Y

7S

8. Exempt contributions made to the Missouri Savings for Tuition Program (MO$T) and/or Missouri

00

00

Higher Education Deposit Program (maximum subtraction is $8,000 per individual) . . . . . . . . . . . .

8Y

8S

9. Missouri depreciation adjustment (Section 143.121, RSMo)

00

00

Sold or disposed property previously taken as addition modification . . . . . . . . . . . . . . . . . . . . . 9Y

9S

00

00

10. TOTAL SUBTRACTIONS — Add Lines 5, 6, 7, 8, and 9. Enter here and on Form MO-1040, Line 4. 10Y

10S

PART 2 — MISSOURI ITEMIZED DEDUCTIONS — Complete this section only if you itemize deductions on your federal

return. Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A.

1

00

1. Total federal itemized deductions from Federal Form 1040, Line 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

2. 2004 (FICA) — yourself — Social security $

+ Medicare $

. . .

3

00

3. 2004 (FICA) — spouse — Social security $

+ Medicare $

. . .

4

00

4. 2004 Railroad retirement tax — yourself (Tier I and Tier II) $

+ Medicare $

. .

5

00

5. 2004 Railroad retirement tax — spouse (Tier I and Tier II) $

+ Medicare $

. .

6

00

6. 2004 Self-employment tax — Amount from Federal Form 1040, Line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

7. TOTAL — Add Lines 1 through 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. State and local income taxes — (If you checked Federal Schedule A, Box 5B, general sales

8

00

tax, enter zero and skip to Line 10.) See instructions on Page 12. . . . . . . . . . . . . . . . . . . . . . .

9

00

9. Earnings taxes included in Line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

10. Net state income taxes — Subtract Line 9 from Line 8 or enter Line 8 from the worksheet below. . . . . . . . . . . . . . . . . . . . . . .

11

00

11. MISSOURI ITEMIZED DEDUCTIONS — Subtract Line 10 from Line 7. Enter here and on Form MO-1040, Line 14. . . . . . . .

NOTE: IF LINE 11 IS LESS THAN YOUR FEDERAL STANDARD DEDUCTION, SEE INFORMATION ON PAGE 7.

It is not necessary to complete the worksheet below if you chose to use state sales tax on Federal Schedule A, Line 5.

Complete this worksheet only if your federal adjusted gross income from Federal Form 1040, Line 36 is more than $142,700 ($71,350 if married filing sepa-

rate). If your federal adjusted gross income is less than or equal to these amounts, do not complete this worksheet. See the instructions for the amount to

enter on Line 10 above. Attach a copy of your Federal Itemized Deduction Worksheet (Page A-6 of Federal Schedule A instructions).

1. Enter amount from Federal Itemized Deduction Worksheet, Line 3

1

00

(See page A-6 of Federal Schedule A instructions.) If $0 or less, enter “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Enter amount from Federal Itemized Deduction Worksheet, Line 9

2

00

(See page A-6 of Federal Schedule A instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

3. State and local income taxes from Federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

4. Earnings taxes included on Federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

5. Subtract Line 4 from Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

6

6. Divide Line 5 by Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

7. Multiply Line 2 by Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

8. Subtract Line 7 from Line 5. Enter here and on Form MO-A, Part 2, Line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . .

MO 860-1881 (11-2004)

For Privacy Notice, see page 43 of the instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2