Hotel/motel Occupancy Tax Return Form - Fulton County

ADVERTISEMENT

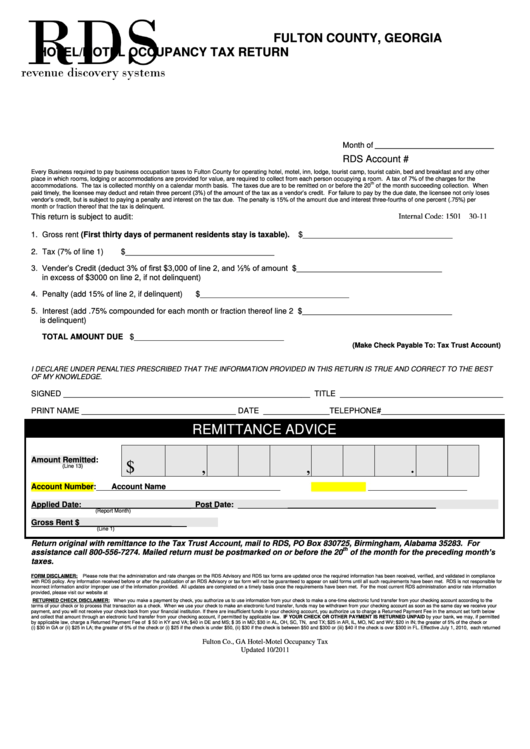

FULTON COUNTY, GEORGIA

HOTEL/MOTEL OCCUPANCY TAX RETURN

Month of ___________________________

RDS Account #

Every Business required to pay business occupation taxes to Fulton County for operating hotel, motel, inn, lodge, tourist camp, tourist cabin, bed and breakfast and any other

place in which rooms, lodging or accommodations are provided for value, are required to collect from each person occupying a room. A tax of 7% of the charges for the

th

accommodations. The tax is collected monthly on a calendar month basis. The taxes due are to be remitted on or before the 20

of the month succeeding collection. When

paid timely, the licensee may deduct and retain three percent (3%) of the amount of the tax as a vendor’s credit. For failure to pay by the due date, the licensee not only loses

vendor’s credit, but is subject to paying a penalty and interest on the tax due. The penalty is 15% of the amount due and interest three-fourths of one percent (.75%) per

month or fraction thereof that the tax is delinquent.

This return is subject to audit:

Internal Code: 1501 30-11

1. Gross rent (First thirty days of permanent residents stay is taxable).

$__________________________________

2. Tax (7% of line 1)

$__________________________________

3. Vender’s Credit (deduct 3% of first $3,000 of line 2, and ½% of amount

$_________________________________

in excess of $3000 on line 2, if not delinquent)

4. Penalty (add 15% of line 2, if delinquent)

$__________________________________

5. Interest (add .75% compounded for each month or fraction thereof line 2

$__________________________________

is delinquent)

TOTAL AMOUNT DUE

$__________________________________

(Make Check Payable To: Tax Trust Account)

I DECLARE UNDER PENALTIES PRESCRIBED THAT THE INFORMATION PROVIDED IN THIS RETURN IS TRUE AND CORRECT TO THE BEST

OF MY KNOWLEDGE.

SIGNED ________________________________________________________ TITLE _____________________________________

PRINT NAME ___________________________________ DATE _______________TELEPHONE#____________________________

REMITTANCE ADVICE

Amount Remitted:

$

,

,

.

(Line 13)

Account Number:

Account Name

Applied Date:_________________________

Post Date:

________________

(Report Month)

Gross Rent $_____________________

(Line 1)

Return original with remittance to the Tax Trust Account, mail to RDS, PO Box 830725, Birmingham, Alabama 35283. For

th

of the month for the preceding month’s

assistance call 800-556-7274. Mailed return must be postmarked on or before the 20

taxes.

FORM DISCLAIMER:

Please note that the administration and rate changes on the RDS Advisory and RDS tax forms are updated once the required information has been received, verified, and validated in compliance

with RDS policy. Any information received before or after the publication of an RDS Advisory or tax form will not be guaranteed to appear on said forms until all such requirements have been met. RDS is not responsible for

incorrect information and/or improper use of the information provided. All updates are completed on a timely basis once the requirements have been met. For the most current RDS administration and/or rate information

provided, please visit our website at

RETURNED CHECK DISCLAIMER: When you make a payment by check, you authorize us to use information from your check to make a one-time electronic fund transfer from your checking account according to the

terms of your check or to process that transaction as a check. When we use your check to make an electronic fund transfer, funds may be withdrawn from your checking account as soon as the same day we receive your

payment, and you will not receive your check back from your financial institution. If there are insufficient funds in your checking account, you authorize us to charge a Returned Payment Fee in the amount set forth below

and collect that amount through an electronic fund transfer from your checking account, if permitted by applicable law. IF YOUR CHECK OR OTHER PAYMENT IS RETURNED UNPAID by your bank, we may, if permitted

by applicable law, charge a Returned Payment Fee of $ 50 in KY and VA; $40 in DE and MS; $ 35 in MD; $30 in AL, OH, SC, TN, and TX; $25 in AR, IL, MO, NC and WV; $20 in IN; the greater of 5% of the check or

(i) $30 in GA or (ii) $25 in LA; the greater of 5% of the check or (i) $25 if the check is under $50, (ii) $30 if the check is between $50 and $300 or (iii) $40 if the check is over $300 in FL. Effective July 1, 2010, each returned

Fulton Co., GA Hotel-Motel Occupancy Tax

Updated 10/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2