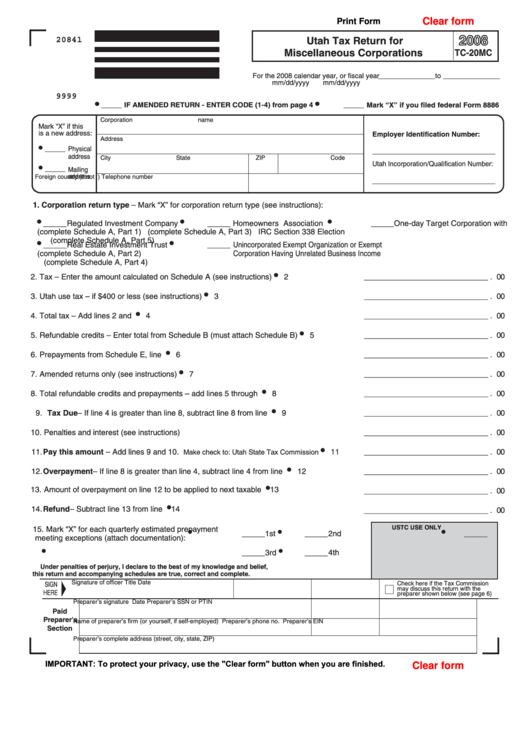

Clear form

Print Form

20841

Utah Tax Return for

Miscellaneous Corporations

TC-20MC

For the 2008 calendar year, or fiscal year______________ to ______________

mm/dd/yyyy

mm/dd/yyyy

9999

__ _ IF AMENDED RETURN - ENTER CODE (1-4) from page 4

__ _ Mark “X” if you filed federal Form 8886

Corporation name

Mark “X” if this

is a new address:

Employer Identification Number:

Address

__ _ Physical

_____ _ _ _ ___________

address

City

State

ZIP Code

Utah Incorporation/Qualification Number:

__ _ Mailing

address

Foreign country (if not U.S.)

Telephone number

_____ _ _ _ ___________

1. Corporation return type – Mark “X” for corporation return type (see instructions):

__ _ Regulated Investment Company

___ Homeowners Association

___ One-day Target Corporation with

(complete Schedule A, Part 1)

(complete Schedule A, Part 3)

IRC Section 338 Election

(complete Schedule A, Part 5)

__ _ Real Estate Investment Trust

___ Unincorporated Exempt Organization or Exempt

(complete Schedule A, Part 2)

Corporation Having Unrelated Business Income

(complete Schedule A, Part 4)

2. Tax – Enter the amount calculated on Schedule A (see instructions).........................

2 ____________ __ _ __ . 00

3. Utah use tax – if $400 or less (see instructions).........................................................

3 ____________ __ _ __ . 00

4. Total tax – Add lines 2 and 3.......................................................................................

4 ____________ __ _ __ . 00

5. Refundable credits – Enter total from Schedule B (must attach Schedule B).............

5 ____________ __ _ __ . 00

6. Prepayments from Schedule E, line 4.........................................................................

6 ____________ __ _ __ . 00

7. Amended returns only (see instructions) ....................................................................

7 ____________ __ _ __ . 00

8. Total refundable credits and prepayments – add lines 5 through 7.............................

8 ____________ __ _ __ . 00

9. Tax Due – If line 4 is greater than line 8, subtract line 8 from line 4 ...........................

9 ____________ __ _ __ . 00

10. Penalties and interest (see instructions) .....................................................................

10 ____________ __ _ __ . 00

11. Pay this amount – Add lines 9 and 10.

......

11 ____________ __ _ __ . 00

Make check to: Utah State Tax Commission

12. Overpayment – If line 8 is greater than line 4, subtract line 4 from line 8..................

12 ____________ __ _ __ . 00

13. Amount of overpayment on line 12 to be applied to next taxable year .......................

13 _____________ __ _ _ . 00

14. Refund – Subtract line 13 from line 12.......................................................................

14 ____________ __ _ __ . 00

USTC USE ONLY

15. Mark “X” for each quarterly estimated prepayment

___ 1st

___ 2nd

_ _ _ _

meeting exceptions (attach documentation):

___ 3rd

___ 4th

Under penalties of perjury, I declare to the best of my knowledge and belief,

this return and accompanying schedules are true, correct and complete.

Signature of officer

Title

Date

Check here if the Tax Commission

SIGN

may discuss this return with the

HERE

preparer shown below (see page 6)

Preparer’s signature

Date

Preparer’s SSN or PTIN

Paid

Preparer's

Name of preparer’s firm (or yourself, if self-employed)

Preparer’s phone no.

Preparer’s EIN

Section

Preparer’s complete address (street, city, state, ZIP)

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2