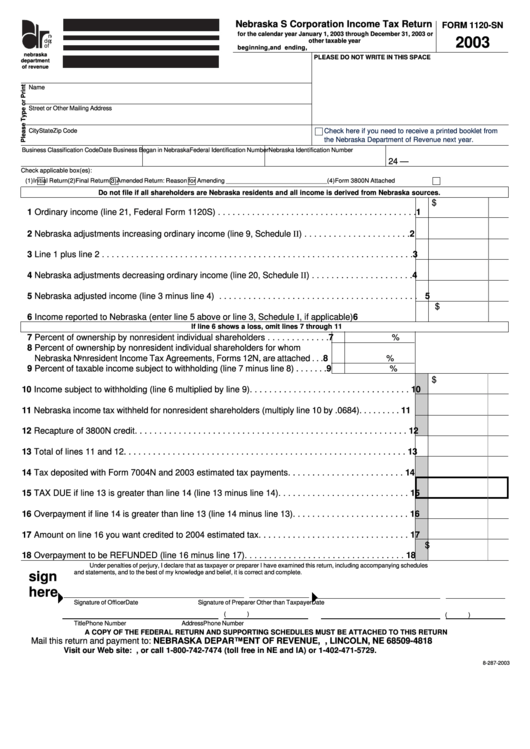

Form 1120-Sn - Nebraska S Corporation Income Tax Return - 2003

ADVERTISEMENT

Nebraska S Corporation Income Tax Return

FORM 1120-SN

for the calendar year January 1, 2003 through December 31, 2003 or

ne

2003

dep

other taxable year

of

beginning

,

and ending

,

nebraska

PLEASE DO NOT WRITE IN THIS SPACE

department

of revenue

Name

Street or Other Mailing Address

City

State

Zip Code

Check here if you need to receive a printed booklet from

the Nebraska Department of Revenue next year.

Business Classification Code

Date Business Began in Nebraska

Federal Identification Number

Nebraska Identification Number

24 —

Check applicable box(es):

(1)

Initial Return

(2)

Final Return

(3)

Amended Return: Reason for Amending _____________________________

(4)

Form 3800N Attached

Do not file if all shareholders are Nebraska residents and all income is derived from Nebraska sources.

$

1 Ordinary income (line 21, Federal Form 1120S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Nebraska adjustments increasing ordinary income (line 9, Schedule II) . . . . . . . . . . . . . . . . . . . . . . 2

3 Line 1 plus line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Nebraska adjustments decreasing ordinary income (line 20, Schedule II) . . . . . . . . . . . . . . . . . . . . . 4

5 Nebraska adjusted income (line 3 minus line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

$

6 Income reported to Nebraska (enter line 5 above or line 3, Schedule I, if applicable)

6

If line 6 shows a loss, omit lines 7 through 11

7 Percent of ownership by nonresident individual shareholders . . . . . . . . . . . . . 7

%

8 Percent of ownership by nonresident individual shareholders for whom

Nebraska Nonresident Income Tax Agreements, Forms 12N, are attached . . . 8

%

9 Percent of taxable income subject to withholding (line 7 minus line 8) . . . . . . . 9

%

$

10 Income subject to withholding (line 6 multiplied by line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Nebraska income tax withheld for nonresident shareholders (multiply line 10 by .0684) . . . . . . . . .

11

12 Recapture of 3800N credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Total of lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Tax deposited with Form 7004N and 2003 estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . .

14

15 TAX DUE if line 13 is greater than line 14 (line 13 minus line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Overpayment if line 14 is greater than line 13 (line 14 minus line 13) . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Amount on line 16 you want credited to 2004 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

$

18 Overpayment to be REFUNDED (line 16 minus line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

Under penalties of perjury, I declare that as taxpayer or preparer I have examined this return, including accompanying schedules

and statements, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Officer

Date

Signature of Preparer Other than Taxpayer

Date

(

)

(

)

Title

Phone Number

Address

Phone Number

A COPY OF THE FEDERAL RETURN AND SUPPORTING SCHEDULES MUST BE ATTACHED TO THIS RETURN

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

Visit our Web site: , or call 1-800-742-7474 (toll free in NE and IA) or 1-402-471-5729.

8-287-2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4