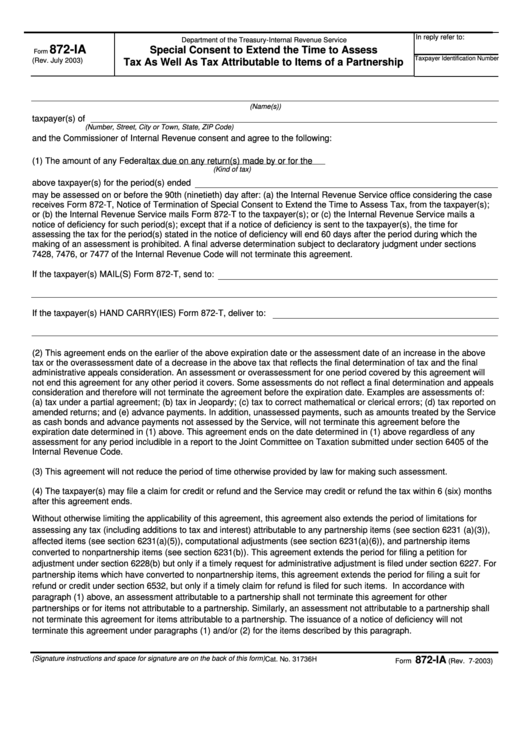

In reply refer to:

Department of the Treasury-Internal Revenue Service

872-IA

Special Consent to Extend the Time to Assess

Form

Taxpayer Identification Number

(Rev. July 2003)

Tax As Well As Tax Attributable to Items of a Partnership

(Name(s))

taxpayer(s) of

(Number, Street, City or Town, State, ZIP Code)

and the Commissioner of Internal Revenue consent and agree to the following:

(1) The amount of any Federal

tax due on any return(s) made by or for the

(Kind of tax)

above taxpayer(s) for the period(s) ended

may be assessed on or before the 90th (ninetieth) day after: (a) the Internal Revenue Service office considering the case

receives Form 872-T, Notice of Termination of Special Consent to Extend the Time to Assess Tax, from the taxpayer(s);

or (b) the Internal Revenue Service mails Form 872-T to the taxpayer(s); or (c) the Internal Revenue Service mails a

notice of deficiency for such period(s); except that if a notice of deficiency is sent to the taxpayer(s), the time for

assessing the tax for the period(s) stated in the notice of deficiency will end 60 days after the period during which the

making of an assessment is prohibited. A final adverse determination subject to declaratory judgment under sections

7428, 7476, or 7477 of the Internal Revenue Code will not terminate this agreement.

If the taxpayer(s) MAIL(S) Form 872-T, send to:

If the taxpayer(s) HAND CARRY(IES) Form 872-T, deliver to:

(2) This agreement ends on the earlier of the above expiration date or the assessment date of an increase in the above

tax or the overassessment date of a decrease in the above tax that reflects the final determination of tax and the final

administrative appeals consideration. An assessment or overassessment for one period covered by this agreement will

not end this agreement for any other period it covers. Some assessments do not reflect a final determination and appeals

consideration and therefore will not terminate the agreement before the expiration date. Examples are assessments of:

(a) tax under a partial agreement; (b) tax in Jeopardy; (c) tax to correct mathematical or clerical errors; (d) tax reported on

amended returns; and (e) advance payments. In addition, unassessed payments, such as amounts treated by the Service

as cash bonds and advance payments not assessed by the Service, will not terminate this agreement before the

expiration date determined in (1) above. This agreement ends on the date determined in (1) above regardless of any

assessment for any period includible in a report to the Joint Committee on Taxation submitted under section 6405 of the

Internal Revenue Code.

(3) This agreement will not reduce the period of time otherwise provided by law for making such assessment.

(4) The taxpayer(s) may file a claim for credit or refund and the Service may credit or refund the tax within 6 (six) months

after this agreement ends.

Without otherwise limiting the applicability of this agreement, this agreement also extends the period of limitations for

assessing any tax (including additions to tax and interest) attributable to any partnership items (see section 6231 (a)(3)),

affected items (see section 6231(a)(5)), computational adjustments (see section 6231(a)(6)), and partnership items

converted to nonpartnership items (see section 6231(b)). This agreement extends the period for filing a petition for

adjustment under section 6228(b) but only if a timely request for administrative adjustment is filed under section 6227. For

partnership items which have converted to nonpartnership items, this agreement extends the period for filing a suit for

refund or credit under section 6532, but only if a timely claim for refund is filed for such items. In accordance with

paragraph (1) above, an assessment attributable to a partnership shall not terminate this agreement for other

partnerships or for items not attributable to a partnership. Similarly, an assessment not attributable to a partnership shall

not terminate this agreement for items attributable to a partnership. The issuance of a notice of deficiency will not

terminate this agreement under paragraphs (1) and/or (2) for the items described by this paragraph.

872-IA

(Signature instructions and space for signature are on the back of this form)

Cat. No. 31736H

Form

(Rev. 7-2003)

1

1 2

2