Form 401-T - Corporation Business Tax - New Jersey

ADVERTISEMENT

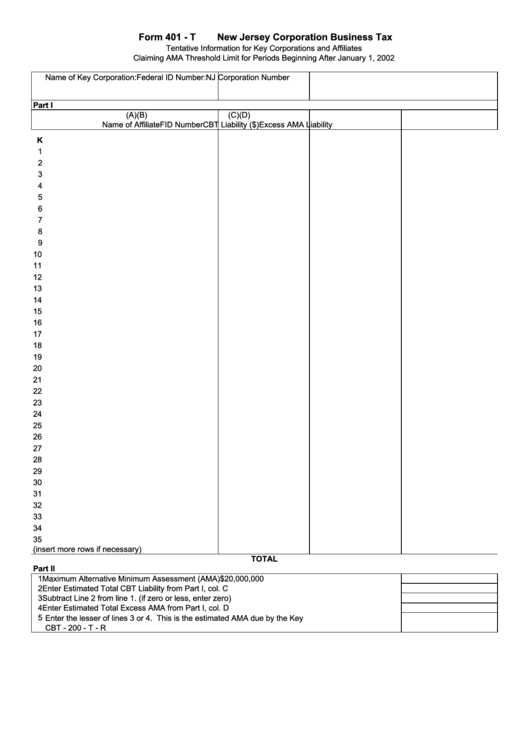

Form 401 - T

New Jersey Corporation Business Tax

Tentative Information for Key Corporations and Affiliates

Claiming AMA Threshold Limit for Periods Beginning After January 1, 2002

Name of Key Corporation:

Federal ID Number:

NJ Corporation Number

Part I

(A)

(B)

(C)

(D)

Name of Affiliate

FID Number

CBT Liability ($)

Excess AMA Liability

K

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

(insert more rows if necessary)

TOTAL

Part II

1 Maximum Alternative Minimum Assessment (AMA)

$20,000,000

2 Enter Estimated Total CBT Liability from Part I, col. C

3 Subtract Line 2 from line 1. (if zero or less, enter zero)

4 Enter Estimated Total Excess AMA from Part I, col. D

5

Enter the lesser of lines 3 or 4. This is the estimated AMA due by the Key corp..Carry to Line 3 of the

CBT - 200 - T - R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1