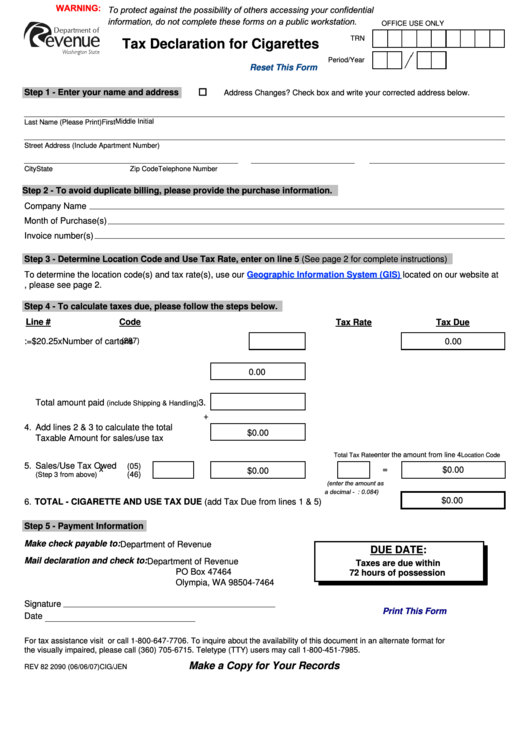

WARNING:

To protect against the possibility of others accessing your confidential

information, do not complete these forms on a public workstation.

OFFICE USE ONLY

TRN

Tax Declaration for Cigarettes

Period/Year

Reset This Form

Step 1 - Enter your name and address

Address Changes? Check box and write your corrected address below.

Middle Initial

Last Name (Please Print)

First

Street Address (Include Apartment Number)

City

State

Zip Code

Telephone Number

Step 2 - To avoid duplicate billing, please provide the purchase information.

Company Name

Month of Purchase(s)

Invoice number(s)

Step 3 - Determine Location Code and Use Tax Rate, enter on line 5 (See page 2 for complete instructions)

To determine the location code(s) and tax rate(s), use our

Geographic Information System (GIS)

located on our website at

For further instructions, please see page 2.

Step 4 - To calculate taxes due, please follow the steps below.

Line #

Code

Tax Rate

Tax Due

1. Cigarette Tax:

(287)

Number of cartons

x

$20.25

=

0.00

2. Enter the amount of Tax Due from Line 1

0.00

3.

Total amount paid

(include Shipping & Handling)

+

4.

Add lines 2 & 3 to calculate the total

$0.00

Taxable Amount for sales/use tax

enter the amount from line 4

Location Code

Total Tax Rate

5.

Sales/Use Tax Owed

(05)

x

=

$0.00

$0.00

(46)

(Step 3 from above)

(enter the amount as

a decimal - i.e.: 0.084)

$0.00

6. TOTAL - CIGARETTE AND USE TAX DUE (add Tax Due from lines 1 & 5)

Step 5 - Payment Information

Make check payable to:

Department of Revenue

DUE DATE:

Mail declaration and check to:

Department of Revenue

Taxes are due within

PO Box 47464

72 hours of possession

Olympia, WA 98504-7464

Signature

Print This Form

Date

For tax assistance visit or call 1-800-647-7706. To inquire about the availability of this document in an alternate format for

the visually impaired, please call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

Make a Copy for Your Records

REV 82 2090

(06/06/07)

CIG/JEN

1

1