Form Ins-1 - Maine Estimated Quarterly Return For Premium And/or Workers Compensation Insurance Tax

ADVERTISEMENT

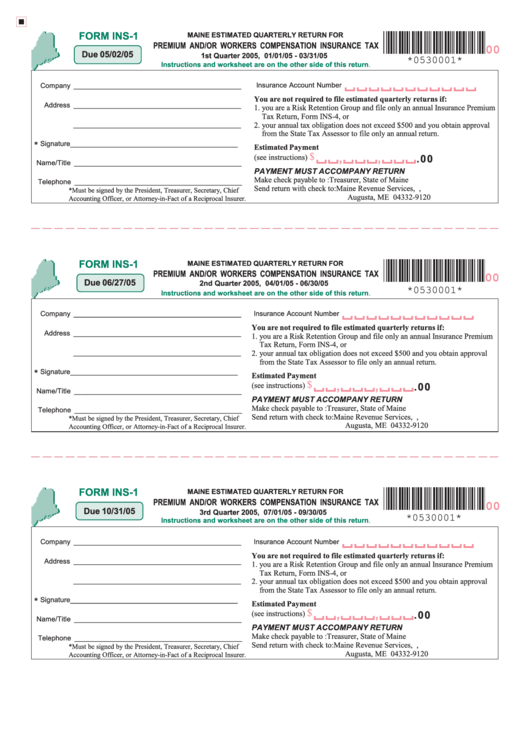

FORM INS-1

MAINE ESTIMATED QUARTERLY RETURN FOR

PREMIUM AND/OR WORKERS COMPENSATION INSURANCE TAX

00

Due 05/02/05

1st Quarter 2005, 01/01/05 - 03/31/05

*0530001*

Instructions and worksheet are on the other side of this return.

Insurance Account Number

Company ___________________________________________

You are not required to file estimated quarterly returns if:

Address ___________________________________________

1. you are a Risk Retention Group and file only an annual Insurance Premium

Tax Return, Form INS-4, or

___________________________________________

2. your annual tax obligation does not exceed $500 and you obtain approval

from the State Tax Assessor to file only an annual return.

*

Signature ___________________________________________

Estimated Payment

$

,

,

(see instructions) ................................

.00

Name/Title ___________________________________________

PAYMENT MUST ACCOMPANY RETURN

Make check payable to :

Treasurer, State of Maine

Telephone ___________________________________________

Send return with check to:

Maine Revenue Services, P.O.Box 9120,

*Must be signed by the President, Treasurer, Secretary, Chief

Augusta, ME 04332-9120

Accounting Officer, or Attorney-in-Fact of a Reciprocal Insurer.

FORM INS-1

MAINE ESTIMATED QUARTERLY RETURN FOR

PREMIUM AND/OR WORKERS COMPENSATION INSURANCE TAX

00

Due 06/27/05

2nd Quarter 2005, 04/01/05 - 06/30/05

*0530001*

Instructions and worksheet are on the other side of this return.

Insurance Account Number

Company ___________________________________________

You are not required to file estimated quarterly returns if:

Address ___________________________________________

1. you are a Risk Retention Group and file only an annual Insurance Premium

Tax Return, Form INS-4, or

___________________________________________

2. your annual tax obligation does not exceed $500 and you obtain approval

from the State Tax Assessor to file only an annual return.

*

Signature ___________________________________________

Estimated Payment

$

,

,

(see instructions) ................................

.00

Name/Title ___________________________________________

PAYMENT MUST ACCOMPANY RETURN

Make check payable to :

Treasurer, State of Maine

Telephone ___________________________________________

Send return with check to:

Maine Revenue Services, P.O.Box 9120,

*Must be signed by the President, Treasurer, Secretary, Chief

Augusta, ME 04332-9120

Accounting Officer, or Attorney-in-Fact of a Reciprocal Insurer.

FORM INS-1

MAINE ESTIMATED QUARTERLY RETURN FOR

PREMIUM AND/OR WORKERS COMPENSATION INSURANCE TAX

00

Due 10/31/05

3rd Quarter 2005, 07/01/05 - 09/30/05

*0530001*

Instructions and worksheet are on the other side of this return.

Company ___________________________________________

Insurance Account Number

You are not required to file estimated quarterly returns if:

Address ___________________________________________

1. you are a Risk Retention Group and file only an annual Insurance Premium

Tax Return, Form INS-4, or

___________________________________________

2. your annual tax obligation does not exceed $500 and you obtain approval

from the State Tax Assessor to file only an annual return.

*

Signature ___________________________________________

Estimated Payment

$

,

,

(see instructions) ................................

.00

Name/Title ___________________________________________

PAYMENT MUST ACCOMPANY RETURN

Make check payable to :

Treasurer, State of Maine

Telephone ___________________________________________

Send return with check to:

Maine Revenue Services, P.O.Box 9120,

*Must be signed by the President, Treasurer, Secretary, Chief

Augusta, ME 04332-9120

Accounting Officer, or Attorney-in-Fact of a Reciprocal Insurer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2