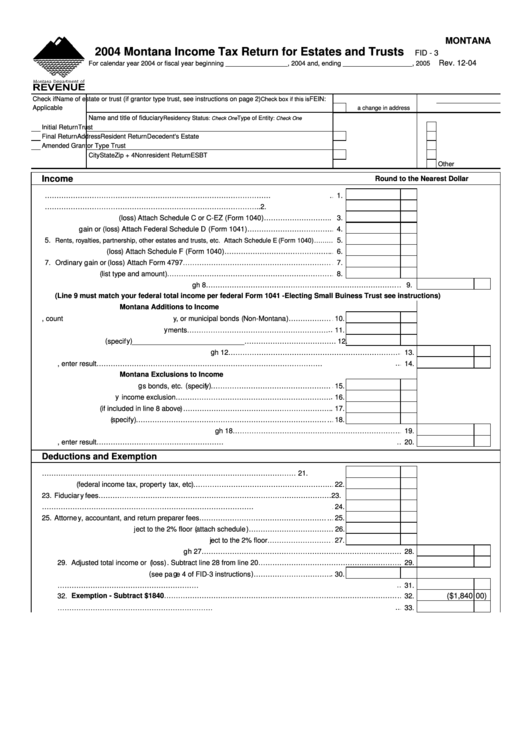

MONTANA

2004 Montana Income Tax Return for Estates and Trusts

FID - 3

Rev. 12-04

For calendar year 2004 or fiscal year beginning _________________, 2004 and, ending ___________________, 2005

Check if

Name of estate or trust (if grantor type trust, see instructions on page 2)

FEIN:

Check box if this is

Applicable

a change in address

Name and title of fiduciary

Residency Status

Type of Entity

: Check One

: Check One

Initial Return

Trust

Final Return

Address

Resident Return

Decedent's Estate

Amended

Grantor Type Trust

City

State

Zip + 4

Nonresident Return

ESBT

Other

Income

Round to the Nearest Dollar

1. Interest income………………………………………………………………………………………1.

2. Ordinary dividends……………………………………………………………………………….. 2.

3. Business income or (loss) Attach Schedule C or C-EZ (Form 1040)……………………….. 3.

4. Capital gain or (loss) Attach Federal Schedule D (Form 1041)………………………………. 4.

5.

Rents, royalties, partnership, other estates and trusts, etc. Attach Schedule E (Form 1040)………

5.

6. Farm income or (loss) Attach Schedule F (Form 1040)…………………………………………6.

7. Ordinary gain or (loss) Attach Form 4797…………………………………………………………7.

8. Other income (list type and amount)………………………………………………………………8.

9. Federal total income. Add lines 1 through 8………………………………………………………………………… 9.

(Line 9 must match your federal total income per federal Form 1041 -Electing Small Buiness Trust see instructions)

Montana Additions to Income

10. Interest and dividends on state, county, or municipal bonds (Non-Montana)………………… 10.

11. Federal income tax refunds/overpayments………………………………………………………11.

12. Other additions (specify)____________________________………………………………… 12.

13. Total additions to income. Add lines 10 through 12…………………………………………………………………13.

14. Add lines 9 and 13, enter result……………………………………………………………………………………… 14.

Montana Exclusions to Income

15. Interest exclusion for savings bonds, etc. (specify)……………………………………………… 15.

16. Pension and annuity income exclusion…………………………………………………………… 16.

17. State refunds (if included in line 8 above)………………………………………………………… 17.

18. Other exclusions (specify)………………………………………………………………………… 18.

19. Total exclusions of income. Add lines 15 through 18……………………………………………………………… 19.

20. Montana total income. Subtract line 19 from line 14, enter result…………………………………………………20.

Deductions and Exemption

21. Interest……………………………………………………………………………………………… 21.

22. Taxes (federal income tax, property tax, etc)……………………………………………………22.

23. Fiduciary fees……………………………………………………………………………………… 23.

24. Charitable deduction………………………………………………………………………………… 24.

25. Attorney, accountant, and return preparer fees………………………………………………… 25.

26. Other deductions not subject to the 2% floor (attach schedule)……………………………… 26.

27. Allowable miscellaneous itemized deductions subject to the 2% floor………………………… 27.

28. Total deductions. Add lines 21 through 27…………………………………………………………………………… 28.

29. Adjusted total income or (loss). Subtract line 28 from line 20……………………………………………………… 29.

30. Income distribution deduction (see page 4 of FID-3 instructions)……………………………… 30.

31. Net income before exemption. Subtract line 30 from line 29……………………………………………………… 31.

32. Exemption - Subtract $1840………………………………………………………………………………………… 32.

($1,840 00)

33. Montana taxable income. Subtract line 32 from line 31…………………………………………………………… 33.

1

1 2

2 3

3 4

4 5

5