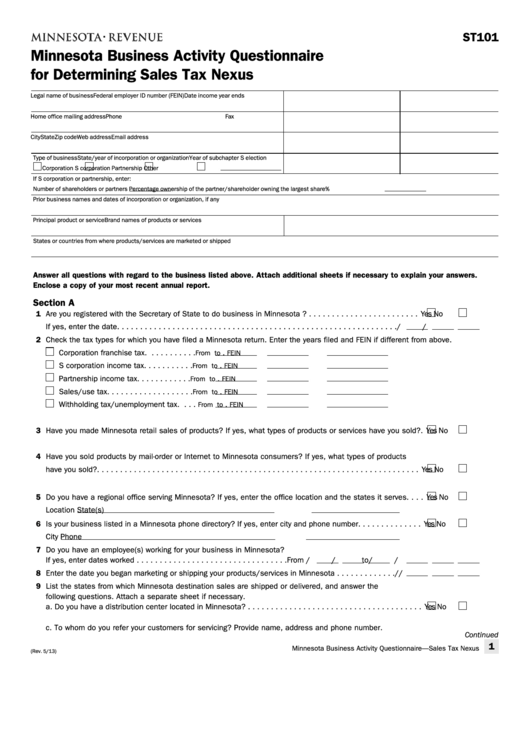

ST101

Minnesota Business Activity Questionnaire

for Determining Sales Tax Nexus

Legal name of business

Federal employer ID number (FEIN)

Date income year ends

Home office mailing address

Phone

Fax

City

State

Zip code

Web address

Email address

Type of business

State/year of incorporation or organization

Year of subchapter S election

Corporation

S corporation

Partnership

Other

If S corporation or partnership, enter:

Number of shareholders or partners

Percentage ownership of the partner/shareholder owning the largest share

%

Prior business names and dates of incor p oration or organization, if any

Principal product or service

Brand names of products or ser vices

States or countries from where products/services are marketed or shipped

Answer all questions with regard to the business listed above. Attach additional sheets if necessary to explain your answers.

Enclose a copy of your most recent annual report.

Section A

1 Are you registered with the Secretary of State to do business in Minnesota ? . . . . . . . . . . . . . . . . . . . . . . . .

Ye s

No

If yes, enter the date. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

/

/

2 Check the tax types for which you ha ve filed a Minnesota retur n. Enter the years filed and FEIN if different from abo ve.

Corporation franchise tax. . . . . . . . . . .

.

From

to

FEIN

S corporation income tax. . . . . . . . . . .

.

From

to

FEIN

Partnership income tax. . . . . . . . . . . .

.

From

to

FEIN

Sales/use tax. . . . . . . . . . . . . . . . . . .

.

From

to

FEIN

Withholding tax/unemployment tax. . . .

.

From

to

FEIN

3 Have you made Minnesota retail sales of products? If yes, what types of products or ser vices have you sold?.

Ye s

No

4 Have you sold products by mail-order or Internet to Minnesota consumer s? If yes, what types of products

have you sold?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Ye s

No

5 Do you have a regional office ser ving Minnesota? If yes, enter the office location and the states it ser ves. . . .

Ye s

No

Location

State(s)

6 Is your business listed in a Minnesota phone directory? If yes, enter city and phone number. . . . . . . . . . . . . .

Ye s

No

City

Phone

7 Do you have an employee(s) working for your business in Minnesota?

If yes, enter dates worked . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . From

/

/

to

/

/

8 Enter the date you began marketing or shipping your products/services in Minnesota . . . . . . . . . . . . .

/

/

9 List the states from which Minnesota destination sales are shipped or delivered, and answer the

following questions. Attach a separate sheet if necessar y.

a. Do you have a distribution center located in Minnesota? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Ye s

No

b. Describe your fulfillment process for Minnesota destination sales.

c. To whom do you refer your customers for ser vicing? Provide name, address and phone number.

Continued

1

Minnesota Business Activity Questionnaire—Sales Tax Nexus

(Rev. 5/13)

1

1 2

2 3

3 4

4 5

5