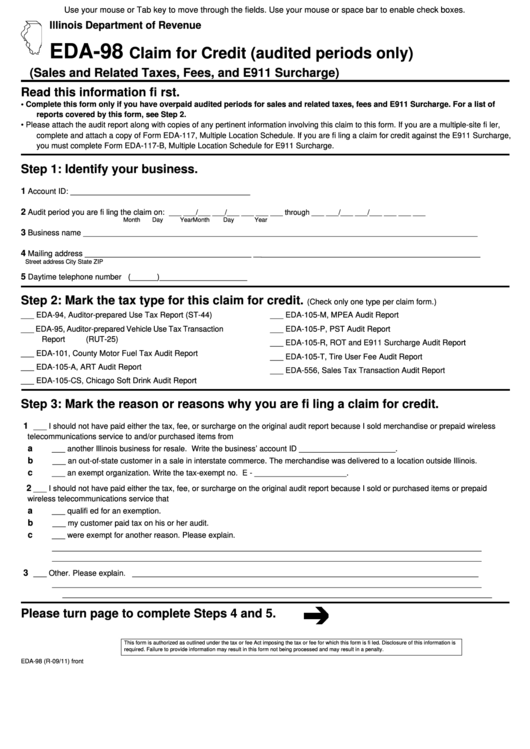

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

EDA-98

Claim for Credit (audited periods only)

(Sales and Related Taxes, Fees, and E911 Surcharge)

Read this information fi rst.

•

Complete this form only if you have overpaid audited periods for sales and related taxes, fees and E911 Surcharge. For a list of

reports covered by this form, see Step 2.

•

Please attach the audit report along with copies of any pertinent information involving this claim to this form. If you are a multiple-site fi ler,

complete and attach a copy of Form EDA-117, Multiple Location Schedule. If you are fi ling a claim for credit against the E911 Surcharge,

you must complete Form EDA-117-B, Multiple Location Schedule for E911 Surcharge.

Step 1: Identify your business.

1

Account ID: _________________________________________

2

Audit period you are fi ling the claim on:

___ ___/___ ___/___ ___ ___ ___ through ___ ___/___ ___/___ ___ ___ ___

Month

Day

Year

Month

Day

Year

3

Business name __________________________________________________________________________________________

4

Mailing address ______________________________________

__________________________________________________

__

Street address

City

State

ZIP

5

Daytime telephone number (______)____________________

Step 2: Mark the tax type for this claim for credit.

(Check only one type per claim form.)

___ EDA-94, Auditor-prepared Use Tax Report (ST-44)

___ EDA-105-M, MPEA Audit Report

___ EDA-95, Auditor-prepared Vehicle Use Tax Transaction

___ EDA-105-P, PST Audit Report

Report (RUT-25)

___

EDA-105-R, ROT and E911 Surcharge Audit Report

___ EDA-101, County Motor Fuel Tax Audit Report

___

EDA-105-T, Tire User Fee Audit Report

___ EDA-105-A, ART Audit Report

___

EDA-556, Sales Tax Transaction Audit Report

___ EDA-105-CS, Chicago Soft Drink Audit Report

Step 3: Mark the reason or reasons why you are fi ling a claim for credit.

1

___ I should not have paid either the tax, fee, or surcharge on the original audit report because I sold merchandise or prepaid wireless

telecommunications service to and/or purchased items from

a

___ another Illinois business for resale. Write the business’ account ID ______________________.

b

___ an out-of-state customer in a sale in interstate commerce. The merchandise was delivered to a location outside Illinois.

c

___ an exempt organization. Write the tax-exempt no. E - _____________________.

2

___ I should not have paid either the tax, fee, or surcharge on the original audit report because I sold or purchased items or prepaid

wireless telecommunications service that

a

___ qualifi ed for an exemption.

b

___ my customer paid tax on his or her audit.

c

___ were exempt for another reason. Please explain.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

3

___ Other. Please explain. _______________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

Please turn page to complete Steps 4 and 5.

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is fi led. Disclosure of this information is

required. Failure to provide information may result in this form not being processed and may result in a penalty.

EDA-98 (R-09/11) front

1

1 2

2