Form Nyc-202-Vr - Unincorporated Business Tax - 2011

ADVERTISEMENT

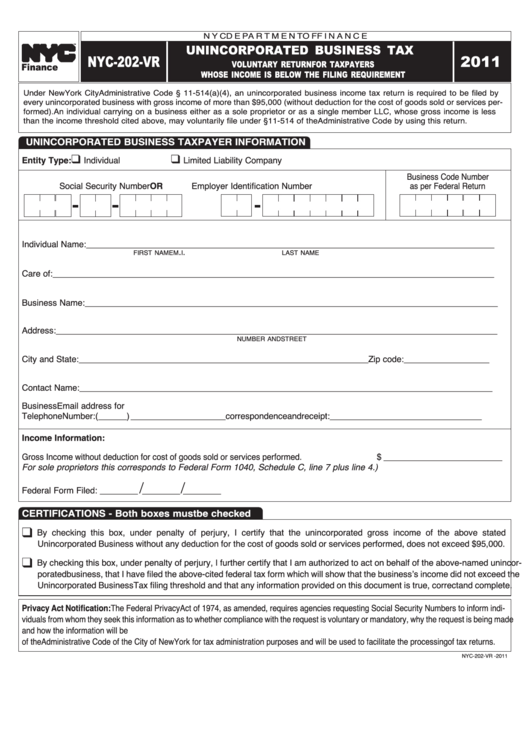

N Y C D E P A R T M E N T O F F I N A N C E

UNINCORPORATED BUSINESS TAX

NYC-202-VR

2011

TM

VOLUNTARY RETURN FOR TAXPAYERS

Finance

WHOSE INCOME IS BELOW THE FILING REQUIREMENT

Under New York City Administrative Code § 11-514(a)(4), an unincorporated business income tax return is required to be filed by

every unincorporated business with gross income of more than $95,000 (without deduction for the cost of goods sold or services per-

formed). An individual carrying on a business either as a sole proprietor or as a single member LLC, whose gross income is less

than the income threshold cited above, may voluntarily file under §11-514 of the Administrative Code by using this return.

UNINCORPORATED BUSINESS TAXPAYER INFORMATION

Entity Type:

Individual

Limited Liability Company

K

K

Business Code Number

OR

Social Security Number

Employer Identification Number

as per Federal Return

Individual Name: ______________________________________________________________________________________

.

.

FIRST NAME

M

I

LAST NAME

Care of: _____________________________________________________________________________________________

Business Name:_______________________________________________________________________________________

Address:_____________________________________________________________________________________________

NUMBER AND STREET

City and State: _____________________________________________________________ Zip code:__________________

Contact Name: _______________________________________________________________________________________

Business

Email address for

Telephone Number: (______) ____________________ correspondence and receipt:________________________________

Income Information:

Gross Income without deduction for cost of goods sold or services performed. .................................. $ _________________________

For sole proprietors this corresponds to Federal Form 1040, Schedule C, line 7 plus line 4.)

/

/

Federal Form Filed: ________

________

________

CERTIFICATIONS - Both boxes must be checked

K

By checking this box, under penalty of perjury, I certify that the unincorporated gross income of the above stated

Unincorporated Business without any deduction for the cost of goods sold or services performed, does not exceed $95,000.

K

By checking this box, under penalty of perjury, I further certify that I am authorized to act on behalf of the above-named unincor-

porated business, that I have filed the above-cited federal tax form which will show that the businessʼs income did not exceed the

Unincorporated Business Tax filing threshold and that any information provided on this document is true, correct and complete.

Privacy Act Notification: The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform indi-

viduals from whom they seek this information as to whether compliance with the request is voluntary or mandatory, why the request is being made

and how the information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by section 11-102.1

of the Administrative Code of the City of New York for tax administration purposes and will be used to facilitate the processing of tax returns.

NYC-202-VR - 2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1