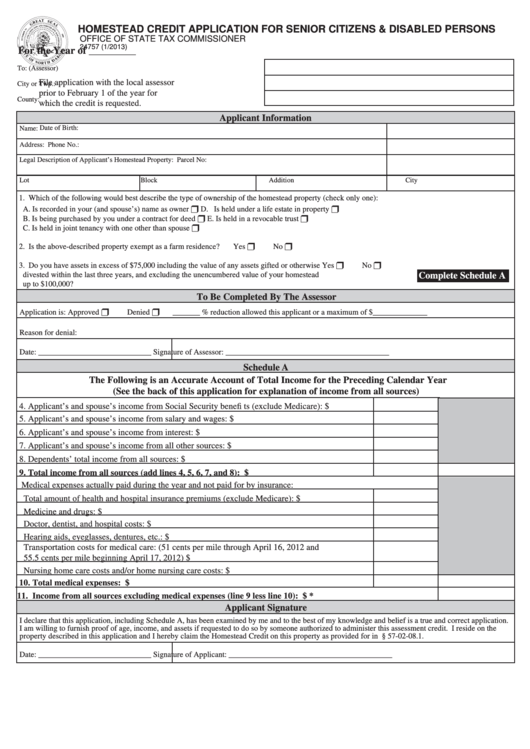

HOMESTEAD CREDIT APPLICATION FOR SENIOR CITIZENS & DISABLED PERSONS

OFFICE OF STATE TAX COMMISSIONER

24757 (1/2013)

For the Year of _________

To: (Assessor)

File application with the local assessor

City or Twp.:

prior to February 1 of the year for

County:

which the credit is requested.

Applicant Information

Date of Birth:

Name:

Address:

Phone No.:

Legal Description of Applicant’s Homestead Property:

Parcel No:

Lot

Block

Addition

City

1. Which of the following would best describe the type of ownership of the homestead property (check only one):

A. Is recorded in your (and spouse’s) name as owner

D. Is held under a life estate in property

B. Is being purchased by you under a contract for deed

E. Is held in a revocable trust

C. Is held in joint tenancy with one other than spouse

Yes

No

2. Is the above-described property exempt as a farm residence?

Yes

No

3. Do you have assets in excess of $75,000 including the value of any assets gifted or otherwise

divested within the last three years, and excluding the unencumbered value of your homestead

Complete Schedule A

up to $100,000?

To Be Completed By The Assessor

Approved

Application is:

Denied

_______ % reduction allowed this applicant or a maximum of $______________

Reason for denial:

Date: _____________________________

Signature of Assessor: __________________________________________

Schedule A

The Following is an Accurate Account of Total Income for the Preceding Calendar Year

(See the back of this application for explanation of income from all sources)

4. Applicant’s and spouse’s income from Social Security benefi ts (exclude Medicare):

$

5. Applicant’s and spouse’s income from salary and wages:

$

6. Applicant’s and spouse’s income from interest:

$

7. Applicant’s and spouse’s income from all other sources:

$

8. Dependents’ total income from all sources:

$

9. Total income from all sources (add lines 4, 5, 6, 7, and 8):

$

Medical expenses actually paid during the year and not paid for by insurance:

Total amount of health and hospital insurance premiums (exclude Medicare):

$

Medicine and drugs:

$

Doctor, dentist, and hospital costs:

$

Hearing aids, eyeglasses, dentures, etc.:

$

Transportation costs for medical care: (51 cents per mile through April 16, 2012 and

55.5 cents per mile beginning April 17, 2012)

$

Nursing home care costs and/or home nursing care costs:

$

10. Total medical expenses:

$

11. Income from all sources excluding medical expenses (line 9 less line 10):

$

*

Applicant Signature

I declare that this application, including Schedule A, has been examined by me and to the best of my knowledge and belief is a true and correct application.

I am willing to furnish proof of age, income, and assets if requested to do so by someone authorized to administer this assessment credit. I reside on the

property described in this application and I hereby claim the Homestead Credit on this property as provided for in N.D.C.C § 57-02-08.1.

Date: _____________________________

Signature of Applicant: __________________________________________

1

1 2

2