Instruction For Form Cd 419 - Franchise Tax Extension - North Carolina Department Of Revenue

ADVERTISEMENT

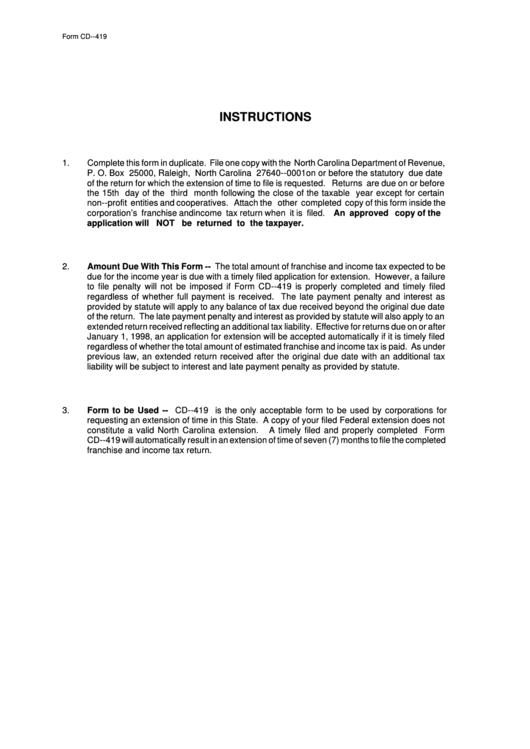

Form CD--419

INSTRUCTIONS

1.

Complete this form in duplicate. File one copy with the North Carolina Department of Revenue,

P. O. Box 25000, Raleigh, North Carolina 27640--0001 on or before the statutory due date

of the return for which the extension of time to file is requested. Returns are due on or before

the 15th day of the third month following the close of the taxable year except for certain

non--profit entities and cooperatives. Attach the other completed copy of this form inside the

corporation’ s franchise and income tax return when it is filed. An approved copy of the

application will NOT be returned to the taxpayer.

2.

Amount Due With This Form -- The total amount of franchise and income tax expected to be

due for the income year is due with a timely filed application for extension. However, a failure

to file penalty will not be imposed if Form CD--419 is properly completed and timely filed

regardless of whether full payment is received. The late payment penalty and interest as

provided by statute will apply to any balance of tax due received beyond the original due date

of the return. The late payment penalty and interest as provided by statute will also apply to an

extended return received reflecting an additional tax liability. Effective for returns due on or after

January 1, 1998, an application for extension will be accepted automatically if it is timely filed

regardless of whether the total amount of estimated franchise and income tax is paid. As under

previous law, an extended return received after the original due date with an additional tax

liability will be subject to interest and late payment penalty as provided by statute.

3.

Form to be Used -- CD--419 is the only acceptable form to be used by corporations for

requesting an extension of time in this State. A copy of your filed Federal extension does not

constitute a valid North Carolina extension.

A timely filed and properly completed Form

CD--419 will automatically result in an extension of time of seven (7) months to file the completed

franchise and income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1