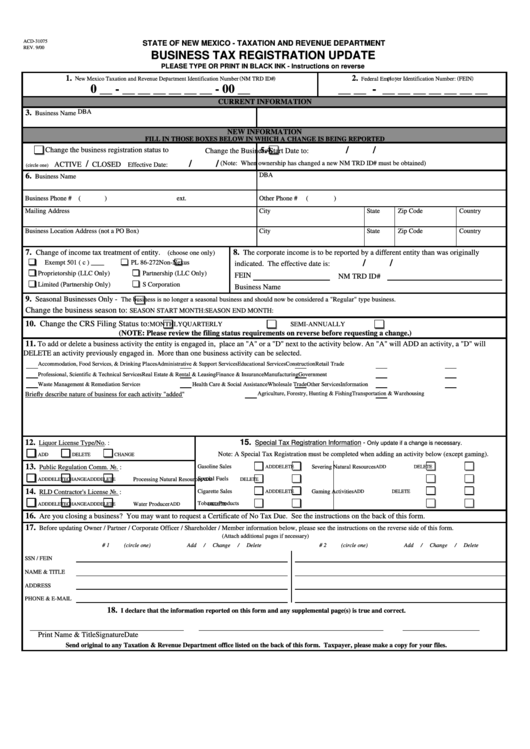

New Mexico Taxation And Revenue Department Business Tax Registration Update Form

ADVERTISEMENT

ACD-31075

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

REV. 9/00

BUSINESS TAX REGISTRATION UPDATE

PLEASE TYPE OR PRINT IN BLACK INK - Instructions on reverse

1.

2.

New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#)

Federal Employer Identification Number: (FEIN)

0 __ - __ __ __ __ __ __ - 00 __

__ __ - __ __ __ __ __ __ __

CURRENT INFORMATION

DBA

3.

Business Name

NEW INFORMATION

FILL IN THOSE BOXES BELOW IN WHICH A CHANGE IS BEING REPORTED

/

/

4.

Change the business registration status to

5.

Change the Business Start Date to:

/

/

/

(Note: When ownership has changed a new NM TRD ID# must be obtained)

ACTIVE

CLOSED

Effective Date:

(circle one)

DBA

6.

Business Name

Business Phone # (

)

ext.

Other Phone #

(

)

Mailing Address

City

State

Zip Code

Country

Business Location Address (not a PO Box)

City

State

Zip Code

Country

7.

8.

Change of income tax treatment of entity.

The corporate income is to be reported by a different entity than was originally

(choose one only)

/

/

Exempt 501 ( c ) ____

PL 86-272

Non-Nexus

indicated. The effective date is:

Proprietorship (LLC Only)

Partnership (LLC Only)

FEIN

NM TRD ID#

Limited (Partnership Only)

S Corporation

Business Name

9.

Seasonal Businesses Only -

The business is no longer a seasonal business and should now be considered a "Regular" type business.

Change the business season to:

SEASON START MONTH:

SEASON END MONTH:

10. Change the CRS Filing Status to:

MONTHLY

QUARTERLY

SEMI-ANNUALLY

(NOTE: Please review the filing status requirements on reverse before requesting a change.)

11.

To add or delete a business activity the entity is engaged in, place an "A" or a "D" next to the activity below. An "A" will ADD an activity, a "D" will

DELETE an activity previously engaged in. More than one business activity can be selected.

Accommodation, Food Services, & Drinking Places

Administrative & Support Services

Educational Services

Construction

Retail Trade

Professional, Scientific & Technical Services

Real Estate & Rental & Leasing

Finance & Insurance

Manufacturing

Government

Waste Management & Remediation Services

Health Care & Social Assistance

Wholesale Trade

Other Services

Information

Agriculture, Forestry, Hunting & Fishing

Transportation & Warehousing

Briefly describe nature of business for each activity "added"

15.

12.

Special Tax Registration Information -

Liquor License Type/No. :

Only update if a change is necessary.

Note: A Special Tax Registration must be completed when adding an activity below (except gaming).

ADD

DELETE

CHANGE

13.

Gasoline Sales

Public Regulation Comm. No. :

ADD

DELETE

Severing Natural Resources

ADD

DELETE

Special Fuels

ADD

DELETE

CHANGE

ADD

DELETE

Processing Natural Resources

ADD

DELETE

14.

Cigarette Sales

RLD Contractor's License No. :

Gaming Activities

ADD

DELETE

ADD

DELETE

Tobacco Products

Water Producer

ADD

DELETE

CHANGE

ADD

DELETE

ADD

DELETE

16.

Are you closing a business? You may want to request a Certificate of No Tax Due. See the instructions on the back of this form.

17.

Before updating Owner / Partner / Corporate Officer / Shareholder / Member information below, please see the instructions on the reverse side of this form.

(Attach additional pages if necessary)

# 1

(circle one)

Add

/

Change

/

Delete

# 2

(circle one)

Add

/

Change

/

Delete

SSN / FEIN

NAME & TITLE

ADDRESS

PHONE & E-MAIL

18.

I declare that the information reported on this form and any supplemental page(s) is true and correct.

Print Name & Title

Signature

Date

Send original to any Taxation & Revenue Department office listed on the back of this form. Taxpayer, please make a copy for your files.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1