Request For Automatic Four Month Extension Form - City Of Stow, Ohio Income Tax Division

ADVERTISEMENT

City of Stow

Income Tax Division

P.O. Box 1668 • Stow, Ohio 44224

(330) 689-2849

Dear Resident,

Providing our residents with excellent service and professional management of the City’s finances has always been our primary

objective. During the past year we have had three notable achievements:

• The Auditor of the State of Ohio presented us with the State Auditor’s Award for Excellence in Accountability and Financial

Reporting.

• Moody’s Investors Services, Inc. re-evaluated and upgraded the City of Stow’s bond rating from A1 to Aa3. This improved

rating allowed us to refinance our bonded debt and take advantage of current interest rates saving Stow $1,096,588 in

interest charges over the next 16 years.

• For the third consecutive reporting year, the City of Stow’s Finance Department has received a CERTIFICATE OF

ACHIEVEMENT OF EXCELLENCE IN FINANCIAL REPORTING from The Government Finance Officers Association of the

United States and Canada. This Certificate is presented in recognition of the stringent requirements that were met in

preparing our city’s Comprehensive Annual Financial Report (CAFR).

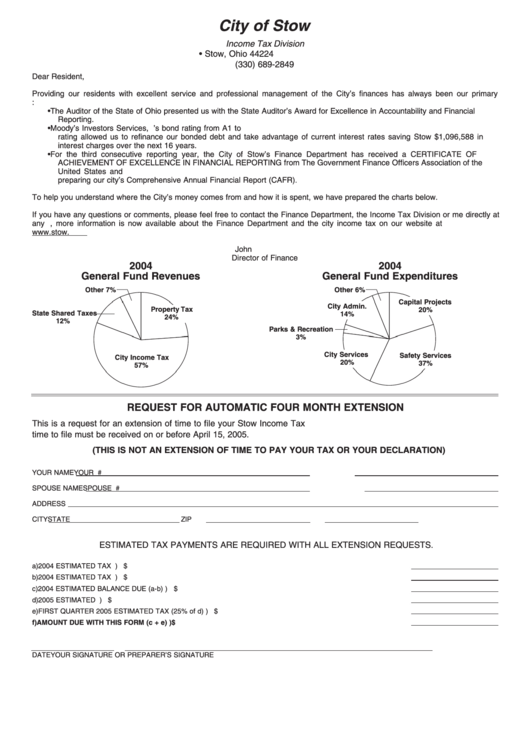

To help you understand where the City’s money comes from and how it is spent, we have prepared the charts below.

If you have any questions or comments, please feel free to contact the Finance Department, the Income Tax Division or me directly at

any time. In addition, more information is now available about the Finance Department and the city income tax on our website at

John M. Baranek

Director of Finance

2004

2004

General Fund Revenues

General Fund Expenditures

Other 7%

Other 6%

Capital Projects

City Admin.

Property Tax

20%

State Shared Taxes

14%

24%

12%

Parks & Recreation

3%

City Services

Safety Services

City Income Tax

20%

37%

57%

REQUEST FOR AUTOMATIC FOUR MONTH EXTENSION

This is a request for an extension of time to file your Stow Income Tax Return. All requests for an automatic extension of

time to file must be received on or before April 15, 2005.

(THIS IS NOT AN EXTENSION OF TIME TO PAY YOUR TAX OR YOUR DECLARATION)

YOUR NAME

YOUR S.S.#

SPOUSE NAME

SPOUSE S.S.#

ADDRESS

CITY

STATE

ZIP

ESTIMATED TAX PAYMENTS ARE REQUIRED WITH ALL EXTENSION REQUESTS.

a) 2004 ESTIMATED TAX DUE ........................................................................................................................................a) $

b) 2004 ESTIMATED TAX PAID ........................................................................................................................................b) $

c) 2004 ESTIMATED BALANCE DUE (a-b)......................................................................................................................c) $

d) 2005 ESTIMATED TAX ................................................................................................................................................d) $

e) FIRST QUARTER 2005 ESTIMATED TAX (25% of d)..................................................................................................e) $

f) AMOUNT DUE WITH THIS FORM (c + e) .................................................................................................................. f) $

DATE

YOUR SIGNATURE OR PREPARER’S SIGNATURE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1