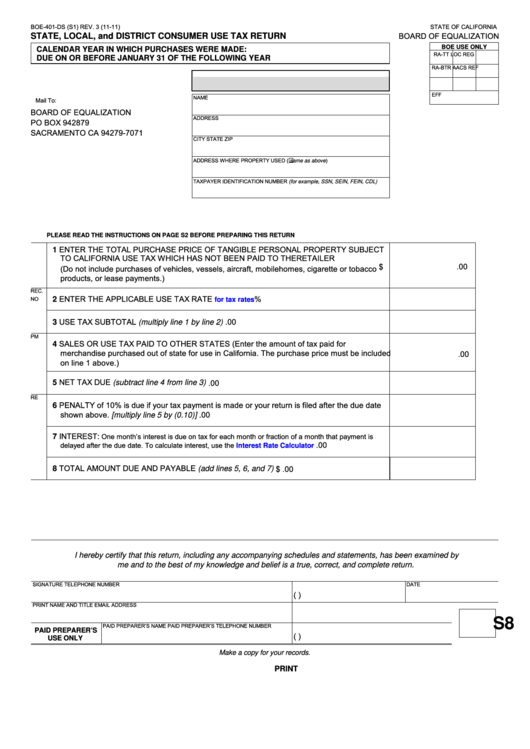

BOE-401-DS (S1) REV. 3 (11-11)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

STATE, LOCAL, and DISTRICT CONSUMER USE TAX RETURN

BOE USE ONLY

CALENDAR YEAR IN WHICH PURCHASES WERE MADE:

RA-TT

LOC

REG

DUE ON OR BEFORE JANUARY 31 OF THE FOLLOWING YEAR

RA-BTR

AACS

REF

EFF

NAME

Mail To:

BOARD OF EQUALIZATION

ADDRESS

PO BOX 942879

SACRAMENTO CA 94279-7071

CITY

STATE

ZIP

ADDRESS WHERE PROPERTY USED (

same as above)

TAXPAYER IDENTIFICATION NUMBER (for example, SSN, SEIN, FEIN, CDL)

PLEASE READ THE INSTRUCTIONS ON PAGE S2 BEFORE PREPARING THIS RETURN

1 ENTER THE TOTAL PURCHASE PRICE OF TANGIBLE PERSONAL PROPERTY SUBJECT

TO CALIFORNIA USE TAX WHICH HAS NOT BEEN PAID TO THE RETAILER

$

.00

(Do not include purchases of vehicles, vessels, aircraft, mobilehomes, cigarette or tobacco

products, or lease payments.)

REC.

2 ENTER THE APPLICABLE USE TAX RATE

%

NO

Click here for tax rates

3 USE TAX SUBTOTAL (multiply line 1 by line 2)

.00

PM

4 SALES OR USE TAX PAID TO OTHER STATES (Enter the amount of tax paid for

merchandise purchased out of state for use in California. The purchase price must be included

.00

on line 1 above.)

5 NET TAX DUE (subtract line 4 from line 3)

.00

RE

6 PENALTY of 10% is due if your tax payment is made or your return is filed after the due date

shown above. [multiply line 5 by (0.10)]

.00

7 INTEREST:

One month’s interest is due on tax for each month or fraction of a month that payment is

.00

delayed after the due date. To calculate interest, use the

Interest Rate Calculator

8 TOTAL AMOUNT DUE AND PAYABLE (add lines 5, 6, and 7)

$

.00

I hereby certify that this return, including any accompanying schedules and statements, has been examined by

me and to the best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

TELEPHONE NUMBER

DATE

(

)

PRINT NAME AND TITLE

EMAIL ADDRESS

S8

PAID PREPARER’S NAME

PAID PREPARER’S TELEPHONE NUMBER

PAID PREPARER’S

(

)

USE ONLY

Make a copy for your records.

CLEAR

PRINT

1

1