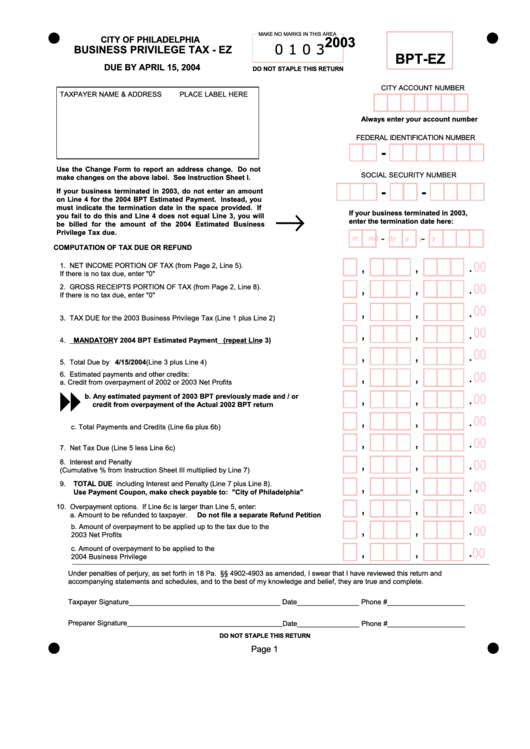

Form Bpt-Ez - Business Privilege Tax - 2003

ADVERTISEMENT

MAKE NO MARKS IN THIS AREA

CITY OF PHILADELPHIA

2003

0 1 0 3

BUSINESS PRIVILEGE TAX - EZ

BPT-EZ

DUE BY APRIL 15, 2004

DO NOT STAPLE THIS RETURN

CITY ACCOUNT NUMBER

TAXPAYER NAME & ADDRESS

PLACE LABEL HERE

Always enter your account number

FEDERAL IDENTIFICATION NUMBER

-

Use the Change Form to report an address change. Do not

SOCIAL SECURITY NUMBER

make changes on the above label. See Instruction Sheet I.

-

-

If your business terminated in 2003, do not enter an amount

on Line 4 for the 2004 BPT Estimated Payment. Instead, you

→

must indicate the termination date in the space provided. If

If your business terminated in 2003,

you fail to do this and Line 4 does not equal Line 3, you will

enter the termination date here:

be billed for the amount of the 2004 Estimated Business

Privilege Tax due.

-

-

m

m

d

d

y

y

y

y

COMPUTATION OF TAX DUE OR REFUND

00

,

,

.

1. NET INCOME PORTION OF TAX (from Page 2, Line 5).

If there is no tax due, enter "0".....................................................................................1.

00

,

,

.

2. GROSS RECEIPTS PORTION OF TAX (from Page 2, Line 8).

If there is no tax due, enter "0".................................................................................... 2.

00

,

,

.

3. TAX DUE for the 2003 Business Privilege Tax (Line 1 plus Line 2)..............................3.

00

,

,

.

4. MANDATORY 2004 BPT Estimated Payment (repeat Line 3)...................................4.

00

,

,

.

5. Total Due by 4/15/2004 (Line 3 plus Line 4).................................................................5.

00

,

,

.

6. Estimated payments and other credits:

a. Credit from overpayment of 2002 or 2003 Net Profits Tax......................................6a.

00

,

,

.

b. Any estimated payment of 2003 BPT previously made and / or

credit from overpayment of the Actual 2002 BPT return............................6b.

00

,

,

.

c. Total Payments and Credits (Line 6a plus 6b).......................................................6c.

,

,

.

00

7. Net Tax Due (Line 5 less Line 6c)................................................................................7.

,

,

.

00

8. Interest and Penalty

(Cumulative % from Instruction Sheet III multiplied by Line 7).....................................8.

,

,

.

00

9. TOTAL DUE including Interest and Penalty (Line 7 plus Line 8).

Use Payment Coupon, make check payable to: "City of Philadelphia".................9.

,

,

.

00

10. Overpayment options. If Line 6c is larger than Line 5, enter:

a. Amount to be refunded to taxpayer. Do not file a separate Refund Petition....10a.

,

,

.

b. Amount of overpayment to be applied up to the tax due to the

00

2003 Net Profits tax.............................................................................................10b.

,

,

.

c. Amount of overpayment to be applied to the

00

2004 Business Privilege tax.................................................................................10c.

Under penalties of perjury, as set forth in 18 Pa. C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature_______________________________________

Date________________ Phone #____________________

Preparer Signature________________________________________ Date________________ Phone #____________________

DO NOT STAPLE THIS RETURN

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2