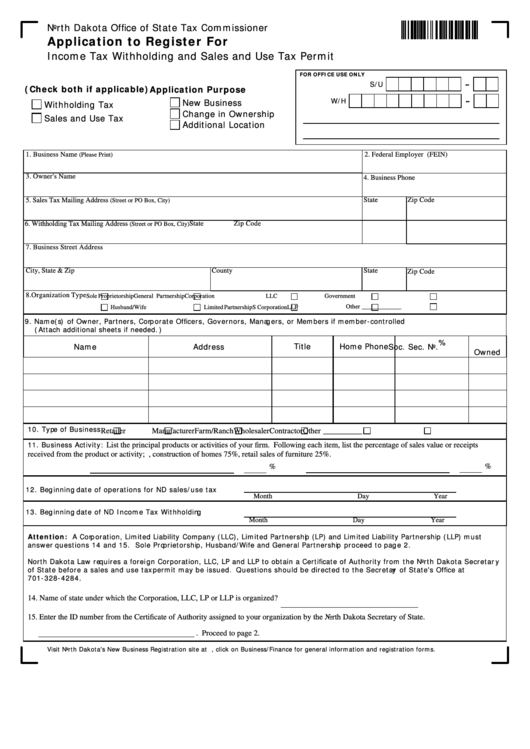

North Dakota Office of State Tax Commissioner

Application to Register For

Income Tax Withholding and Sales and Use Tax Permit

FOR OFFICE USE ONLY

-

S/U

(Check both if applicable)

Application Purpose

-

W/H

New Business

Withholding Tax

Change in Ownership

Sales and Use Tax

Additional Location

1. Business Name

2. Federal Employer I.D. Number (FEIN)

(Please Print)

3. Owner's Name

4. Business Phone

5. Sales Tax Mailing Address

State

Zip Code

(Street or PO Box, City)

State

Zip Code

6. Withholding Tax Mailing Address

(Street or PO Box, City)

7. Business Street Address

City, State & Zip

County

State

Zip Code

8. Organization Type

Sole Proprietorship

General Partnership

Corporation

LLC

Government

Other _____________

Husband/Wife

Limited Partnership

S Corporation

LLP

9. Name(s) of Owner, Partners, Corporate Officers, Governors, Managers, or Members if member-controlled

(Attach additional sheets if needed.)

%

Title

Home Phone

Name

Address

Soc. Sec. No.

Owned

10. Type of Business

Retailer

Manufacturer

Farm/Ranch

Wholesaler

Contractor

Other __________

11. Business Activity:

List the principal products or activities of your firm. Following each item, list the percentage of sales value or receipts

received from the product or activity; i.e., construction of homes 75%, retail sales of furniture 25%.

%

%

12. Beginning date of operations for ND sales/use tax

Month

Day

Year

13. Beginning date of ND Income Tax Withholding

Month

Day

Year

Attention: A Corporation, Limited Liability Company (LLC), Limited Partnership (LP) and Limited Liability Partnership (LLP) must

answer questions 14 and 15. Sole Proprietorship, Husband/Wife and General Partnership proceed to page 2.

North Dakota Law requires a foreign Corporation, LLC, LP and LLP to obtain a Certificate of Authority from the North Dakota Secretary

of State before a sales and use tax permit may be issued. Questions should be directed to the Secretary of State's Office at

701-328-4284.

14. Name of state under which the Corporation, LLC, LP or LLP is organized?

15. Enter the ID number from the Certificate of Authority assigned to your organization by the North Dakota Secretary of State.

. Proceed to page 2.

Visit North Dakota's New Business Registration site at , click on Business/Finance for general information and registration forms.

1

1 2

2