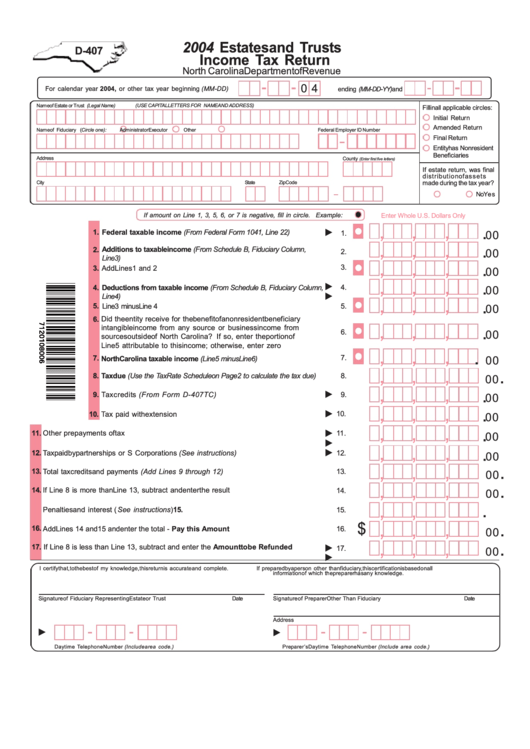

Form D407 - Estates And Trusts Income Tax Return - 2004

ADVERTISEMENT

2004 Estates and Trusts

D-407

Income Tax Return

North Carolina Department of Revenue

0 4

For calendar year 2004, or other tax year beginning (MM-DD)

and

ending (MM-DD-YY)

Name of Estate or Trust (Legal Name)

(USE CAPITAL LETTERS FOR NAME AND ADDRESS)

Fill in all applicable circles:

Initial Return

Amended Return

Name of Fiduciary (Circle one):

Administrator

Executor

Other

Federal Employer ID Number

Final Return

Entity has Nonresident

Beneficiaries

Address

County

(Enter first five letters)

If estate return, was final

distribution of assets

made during the tax year?

City

State

Zip Code

Yes

No

If amount on Line 1, 3, 5, 6, or 7 is negative, fill in circle.

Example:

Enter Whole U.S. Dollars Only

,

,

,

.

1.

Federal taxable income (From Federal Form 1041, Line 22)

00

1.

,

,

,

.

Additions to taxable income (From Schedule B, Fiduciary Column,

2.

2.

00

Line 3)

,

,

,

.

3.

3.

Add Lines 1 and 2

00

,

,

,

.

4.

Deductions from taxable income (From Schedule B, Fiduciary Column,

4.

00

Line 4)

,

,

,

.

5.

5.

Line 3 minus Line 4

00

6.

Did the entity receive for the benefit of a nonresident beneficiary

,

,

,

.

intangible income from any source or business income from

6.

00

sources outside of North Carolina? If so, enter the portion of

Line 5 attributable to this income; otherwise, enter zero

,

,

,

.

7.

7.

00

North Carolina taxable income (Line 5 minus Line 6)

,

,

,

.

8. Tax due (Use the Tax Rate Schedule on Page 2 to calculate the tax due)

8.

00

,

,

,

.

9. Tax credits (From Form D-407TC)

9.

00

,

,

,

.

10.

10. Tax paid with extension

00

,

,

,

.

11.

Other prepayments of tax

11.

00

,

,

,

.

12.

Tax paid by partnerships or S Corporations (See instructions)

12.

00

,

,

,

.

13.

13.

Total tax credits and payments (Add Lines 9 through 12)

00

,

,

,

.

14.

If Line 8 is more than Line 13, subtract and enter the result

14.

00

,

,

,

.

15.

Penalties and interest (See instructions)

15.

00

,

,

,

.

$

16.

Add Lines 14 and 15 and enter the total - Pay this Amount

16.

00

,

,

,

.

17. If Line 8 is less than Line 13, subtract and enter the Amount to be Refunded

17.

00

I certify that, to the best of my knowledge, this return is accurate and complete.

If prepared by a person other than fiduciary, this certification is based on all

information of which the preparer has any knowledge.

Signature of Fiduciary Representing Estate or Trust

Signature of Preparer Other Than Fiduciary

Date

Date

Address

Daytime Telephone Number (Include area code.)

Preparer’s Daytime Telephone Number (Include area code.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5