Form 2610 - Consumers Use Tax Return

ADVERTISEMENT

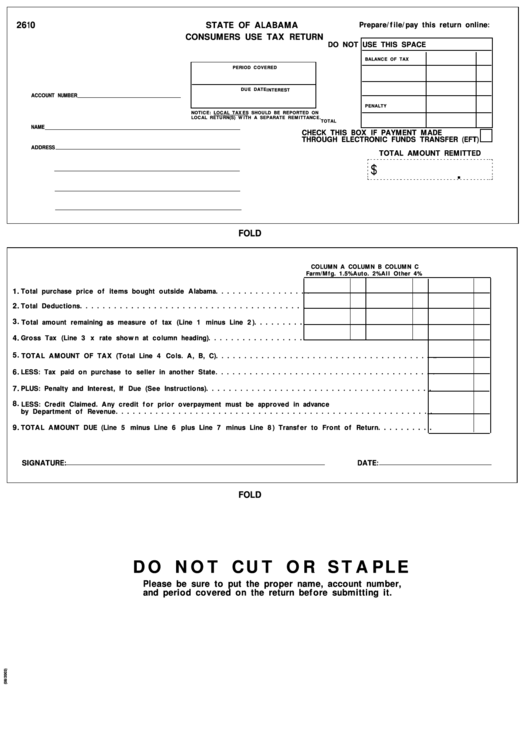

2610

Prepare/file/pay this return online:

STATE OF ALABAMA

CONSUMERS USE TAX RETURN

DO NOT USE THIS SPACE

BALANCE OF TAX

PERIOD COVERED

DUE DATE

INTEREST

ACCOUNT NUMBER

PENALTY

NOTICE: LOCAL TAXES SHOULD BE REPORTED ON

LOCAL RETURN(S) WITH A SEPARATE REMITTANCE.

TOTAL

NAME

CHECK THIS BOX IF PAYMENT MADE

THROUGH ELECTRONIC FUNDS TRANSFER (EFT)

ADDRESS

TOTAL AMOUNT REMITTED

FOLD

COLUMN A

COLUMN B

COLUMN C

Farm/Mfg. 1.5%

Auto. 2%

All Other 4%

1.

Total purchase price of items bought outside Alabama. . . . . . . . . . . . . . . . .

2.

Total Deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Total amount remaining as measure of tax (Line 1 minus Line 2). . . . . . . . .

4.

Gross Tax (Line 3 x rate shown at column heading). . . . . . . . . . . . . . . . .

5.

TOTAL AMOUNT OF TAX (Total Line 4 Cols. A, B, C). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..

6.

LESS: Tax paid on purchase to seller in another State. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

PLUS: Penalty and Interest, If Due (See Instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

LESS: Credit Claimed. Any credit for prior overpayment must be approved in advance

by Department of Revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

TOTAL AMOUNT DUE (Line 5 minus Line 6 plus Line 7 minus Line 8) Transfer to Front of Return. . . . . . . . . .

SIGNATURE:

DATE:

FOLD

DO NOT CUT OR STAPLE

Please be sure to put the proper name, account number,

and period covered on the return before submitting it.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1