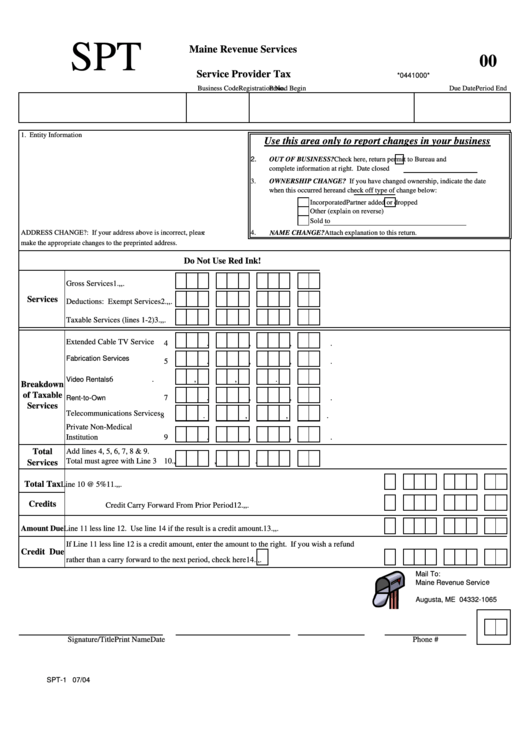

Form Spt-1 - Maine Revenue Services Service Provider Tax - 2004

ADVERTISEMENT

*0441000*

SPT

Maine Revenue Services

00

Service Provider Tax

*0441000*

Registration No.

Business Code

Period Begin

Period End

Due Date

1. Entity Information

Use this area only to report changes in your business

2.

OUT OF BUSINESS?

Check here

, return permit to Bureau and

complete information at right. Date closed

3.

OWNERSHIP CHANGE?

If you have changed ownership, indicate the date

when this occurred here

and check off type of change below:

Incorporated

Partner added or dropped

Other (explain on reverse)

Sold to

ADDRESS CHANGE?: If your address above is incorrect, please

4.

NAME CHANGE?

Attach explanation to this return.

make the appropriate changes to the preprinted address.

Do Not Use Red Ink!

Gross Services

1.

,

,

.

Services

Deductions: Exempt Services 2.

,

,

.

Taxable Services (lines 1-2)

3.

,

,

.

Extended Cable TV Service

4.

,

,

.

Fabrication Services

5.

,

,

.

Video Rentals

6.

,

,

.

Breakdown

of Taxable

7.

,

,

.

Rent-to-Own

Services

Telecommunications Services 8.

,

,

.

Private Non-Medical

Institution

9.

,

,

.

Add lines 4, 5, 6, 7, 8 & 9.

Total

Total must agree with Line 3

10.

,

,

.

Services

Total Tax

Line 10 @ 5%

11.

,

,

.

Credits

Credit Carry Forward From Prior Period

12.

,

,

.

Amount Due

Line 11 less line 12. Use line 14 if the result is a credit amount.

13.

,

,

.

If Line 11 less line 12 is a credit amount, enter the amount to the right. If you wish a refund

Credit Due

rather than a carry forward to the next period, check here

14.

,

,

.

Mail To:

Maine Revenue Service

P.O. Box 1065

Augusta, ME 04332-1065

Signature/Title

Print Name

Date

Phone #

SPT-1 07/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1