Va Form 8454t - Taxpayer Opt Out Form - Virginia Department Of Taxation

ADVERTISEMENT

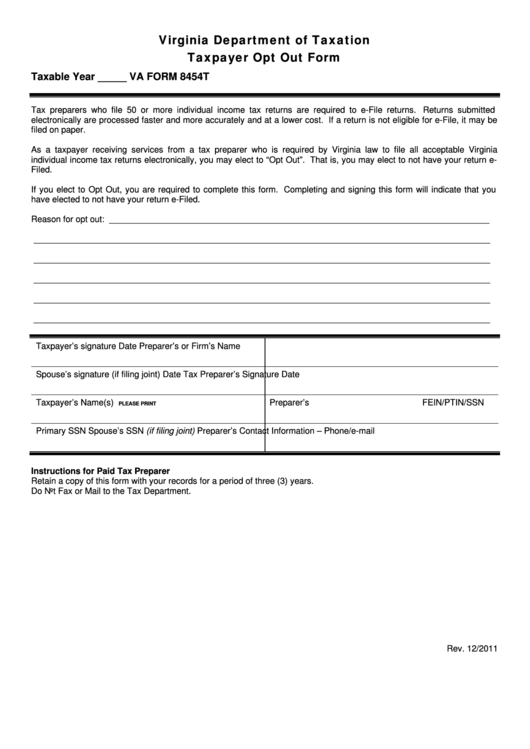

Virginia Department of Taxation

Taxpayer Opt Out Form

Taxable Year _____

VA FORM 8454T

Tax preparers who file 50 or more individual income tax returns are required to e-File returns. Returns submitted

electronically are processed faster and more accurately and at a lower cost. If a return is not eligible for e-File, it may be

filed on paper.

As a taxpayer receiving services from a tax preparer who is required by Virginia law to file all acceptable Virginia

individual income tax returns electronically, you may elect to “Opt Out”. That is, you may elect to not have your return e-

Filed.

If you elect to Opt Out, you are required to complete this form. Completing and signing this form will indicate that you

have elected to not have your return e-Filed.

Reason for opt out: ________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

Taxpayer’s signature

Date

Preparer’s or Firm’s Name

Spouse’s signature (if filing joint)

Date

Tax Preparer’s Signature

Date

Taxpayer’s Name(s)

Preparer’s FEIN/PTIN/SSN

PLEASE PRINT

Primary SSN

Spouse’s SSN (if filing joint)

Preparer’s Contact Information – Phone/e-mail

Instructions for Paid Tax Preparer

Retain a copy of this form with your records for a period of three (3) years.

Do Not Fax or Mail to the Tax Department.

Rev. 12/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1