Instructions For Form St-557 - Claim For Credit For Repossession Of Motor Vehicles, Watercraft, Aircraft, Trailers, And Mobile Homes - Illinois Department Of Revenue

ADVERTISEMENT

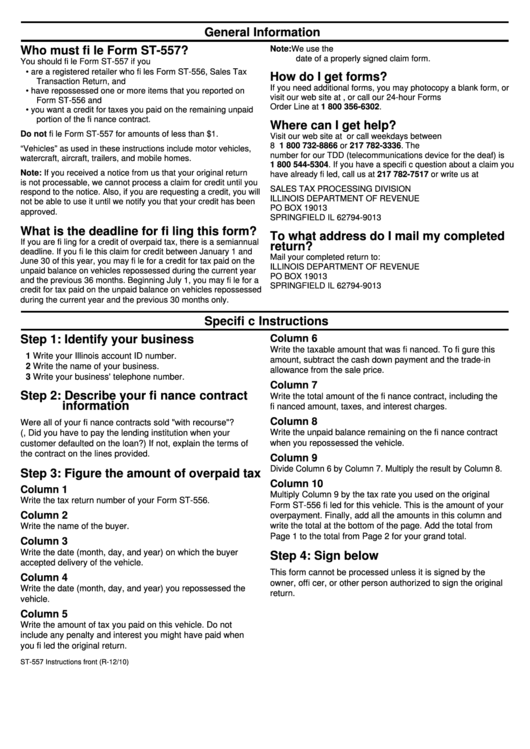

General Information

Who must fi le Form ST-557?

Note: We use the U.S. Postal Service postmark date as the fi ling

date of a properly signed claim form.

You should fi le Form ST-557 if you

• are a registered retailer who fi les Form ST-556, Sales Tax

How do I get forms?

Transaction Return, and

If you need additional forms, you may photocopy a blank form, or

• have repossessed one or more items that you reported on

visit our web site at tax.illinois.gov, or call our 24-hour Forms

Form ST-556 and

Order Line at 1 800 356-6302.

• you want a credit for taxes you paid on the remaining unpaid

portion of the fi nance contract.

Where can I get help?

Do not fi le Form ST-557 for amounts of less than $1.

Visit our web site at tax.illinois.gov or call weekdays between

8 a.m. and 5 p.m. at 1 800 732-8866 or 217 782-3336. The

“Vehicles” as used in these instructions include motor vehicles,

number for our TDD (telecommunications device for the deaf) is

watercraft, aircraft, trailers, and mobile homes.

1 800 544-5304. If you have a specifi c question about a claim you

Note: If you received a notice from us that your original return

have already fi led, call us at 217 782-7517 or write us at

is not processable, we cannot process a claim for credit until you

SALES TAX PROCESSING DIVISION

respond to the notice. Also, if you are requesting a credit, you will

ILLINOIS DEPARTMENT OF REVENUE

not be able to use it until we notify you that your credit has been

PO BOX 19013

approved.

SPRINGFIELD IL 62794-9013

What is the deadline for fi ling this form?

To what address do I mail my completed

If you are fi ling for a credit of overpaid tax, there is a semiannual

return?

deadline. If you fi le this claim for credit between January 1 and

Mail your completed return to:

June 30 of this year, you may fi le for a credit for tax paid on the

ILLINOIS DEPARTMENT OF REVENUE

unpaid balance on vehicles repossessed during the current year

PO BOX 19013

and the previous 36 months. Beginning July 1, you may fi le for a

SPRINGFIELD IL 62794-9013

credit for tax paid on the unpaid balance on vehicles repossessed

during the current year and the previous 30 months only.

Specifi c Instructions

Column 6

Step 1: Identify your business

Write the taxable amount that was fi nanced. To fi gure this

1 Write your Illinois account ID number.

amount, subtract the cash down payment and the trade-in

2 Write the name of your business.

allowance from the sale price.

3 Write your business' telephone number.

Column 7

Step 2: Describe your fi nance contract

Write the total amount of the fi nance contract, including the

information

fi nanced amount, taxes, and interest charges.

Column 8

Were all of your fi nance contracts sold "with recourse"?

Write the unpaid balance remaining on the fi nance contract

(i.e., Did you have to pay the lending institution when your

when you repossessed the vehicle.

customer defaulted on the loan?) If not, explain the terms of

the contract on the lines provided.

Column 9

Divide Column 6 by Column 7. Multiply the result by Column 8.

Step 3: Figure the amount of overpaid tax

Column 10

Column 1

Multiply Column 9 by the tax rate you used on the original

Write the tax return number of your Form ST-556.

Form ST-556 fi led for this vehicle. This is the amount of your

Column 2

overpayment. Finally, add all the amounts in this column and

Write the name of the buyer.

write the total at the bottom of the page. Add the total from

Page 1 to the total from Page 2 for your grand total.

Column 3

Write the date (month, day, and year) on which the buyer

Step 4: Sign below

accepted delivery of the vehicle.

This form cannot be processed unless it is signed by the

Column 4

owner, offi cer, or other person authorized to sign the original

Write the date (month, day, and year) you repossessed the

return.

vehicle.

Column 5

Write the amount of tax you paid on this vehicle. Do not

include any penalty and interest you might have paid when

you fi led the original return.

ST-557 Instructions front (R-12/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1