____

Print Form

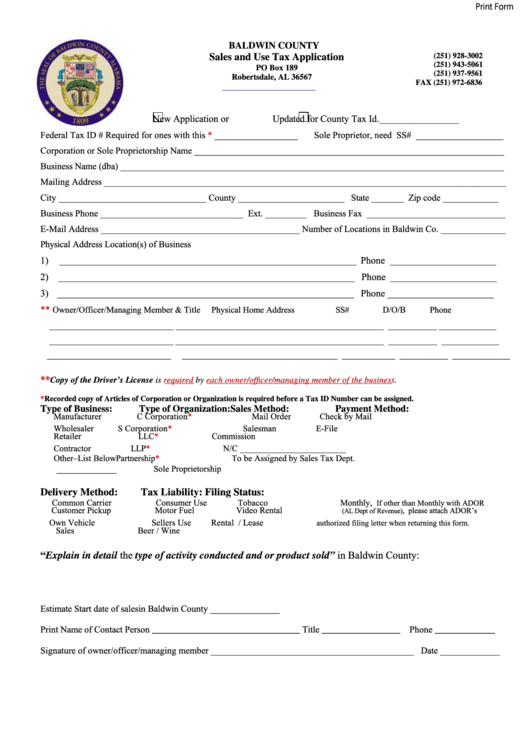

BALDWIN COUNTY

(251) 928-3002

Sales and Use Tax Application

(251) 943-5061

PO Box 189

(251) 937-9561

Robertsdale, AL 36567

FAX (251) 972-6836

New Application

or

Updated for County Tax Id.

__________________

Federal Tax ID # Required for ones with this

*

__________________

Sole Proprietor, need SS# ___________________

Corporation or Sole Proprietorship Name ___________________________________________________________________

Business Name (dba) ___________________________________________________________________________________

Mailing Address _______________________________________________________________________________________

City ________________________________ County _______________________ State _______ Zip code ____________

Business Phone _______________________________ Ext. _________ Business Fax ______________________________

E-Mail Address ___________________________________________ Number of Locations in Baldwin Co. ______________

Physical Address Location(s) of Business

1)

Phone

___________________________________________________________________

________________________

2)

Phone

___________________________________________________________________

________________________

3)

Phone

___________________________________________________________________

________________________

**

Owner/Officer/Managing Member & Title

Physical Home Address

SS#

D/O/B

Phone

____________________________ ___________________________________ ____________ ___________ _____________

____________________________ ___________________________________ ____________ ___________ _____________

____________________________

___________________________________ ____________ ___________ _____________

**

Copy of the Driver’s License is

required

by

each owner/officer/managing member of the

business.

*Recorded copy of Articles of Corporation or Organization is required before a Tax ID Number can be assigned.

Type of Business:

Type of Organization:

Sales Method:

Payment Method:

Manufacturer

C

Corporation*

Mail Order

Check by Mail

Wholesaler

S

Corporation*

Salesman

E-File

Retailer

LLC*

Commission

Contractor

LLP*

N/C ________________________

Other–List Below

Partnership*

To be Assigned by Sales Tax Dept.

_____________

Sole Proprietorship

Delivery Method:

Tax Liability:

Filing Status:

Common Carrier

Consumer Use

Tobacco

Monthly,

If other than Monthly with ADOR

Customer Pickup

Motor Fuel

Video Rental

, please attach ADOR’s

(AL Dept of Revenue)

Own Vehicle

Sellers Use

Rental / Lease

authorized filing letter when returning this form.

Sales

Beer / Wine

“Explain in detail the type of activity conducted and or product sold” in Baldwin County:

Estimate Start date of sales in Baldwin County _______________

Print Name of Contact Person ________________________________ Title _________________ Phone _____________

Signature of owner/officer/managing member ____________________________________________ Date _____________

1

1