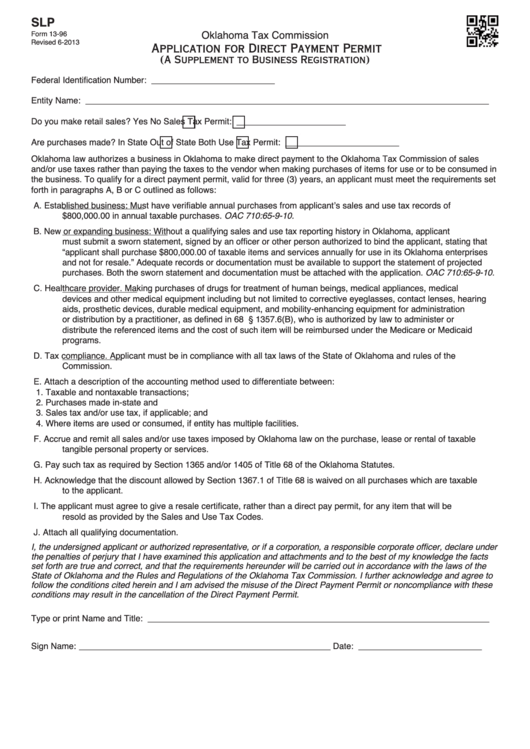

SLP

Oklahoma Tax Commission

Form 13-96

Revised 6-2013

Application for Direct Payment Permit

(A Supplement to Business Registration)

Federal Identification Number: __________________________

Entity Name: _____________________________________________________________________________________

Do you make retail sales?

Yes

No

Sales Tax Permit: _______________________

Are purchases made?

In State

Out of State

Both

Use Tax Permit: ________________________

Oklahoma law authorizes a business in Oklahoma to make direct payment to the Oklahoma Tax Commission of sales

and/or use taxes rather than paying the taxes to the vendor when making purchases of items for use or to be consumed in

the business. To qualify for a direct payment permit, valid for three (3) years, an applicant must meet the requirements set

forth in paragraphs A, B or C outlined as follows:

A. Established business: Must have verifiable annual purchases from applicantʼs sales and use tax records of

$800,000.00 in annual taxable purchases. OAC 710:65-9-10.

B. New or expanding business: Without a qualifying sales and use tax reporting history in Oklahoma, applicant

must submit a sworn statement, signed by an officer or other person authorized to bind the applicant, stating that

“applicant shall purchase $800,000.00 of taxable items and services annually for use in its Oklahoma enterprises

and not for resale.” Adequate records or documentation must be available to support the statement of projected

purchases. Both the sworn statement and documentation must be attached with the application. OAC 710:65-9-10.

C. Healthcare provider. Making purchases of drugs for treatment of human beings, medical appliances, medical

devices and other medical equipment including but not limited to corrective eyeglasses, contact lenses, hearing

aids, prosthetic devices, durable medical equipment, and mobility-enhancing equipment for administration

or distribution by a practitioner, as defined in 68 O.S. § 1357.6(B), who is authorized by law to administer or

distribute the referenced items and the cost of such item will be reimbursed under the Medicare or Medicaid

programs.

D. Tax compliance. Applicant must be in compliance with all tax laws of the State of Oklahoma and rules of the

Commission.

E. Attach a description of the accounting method used to differentiate between:

1. Taxable and nontaxable transactions;

2. Purchases made in-state and

3. Sales tax and/or use tax, if applicable; and

4. Where items are used or consumed, if entity has multiple facilities.

F. Accrue and remit all sales and/or use taxes imposed by Oklahoma law on the purchase, lease or rental of taxable

tangible personal property or services.

G. Pay such tax as required by Section 1365 and/or 1405 of Title 68 of the Oklahoma Statutes.

H. Acknowledge that the discount allowed by Section 1367.1 of Title 68 is waived on all purchases which are taxable

to the applicant.

I.

The applicant must agree to give a resale certificate, rather than a direct pay permit, for any item that will be

resold as provided by the Sales and Use Tax Codes.

J. Attach all qualifying documentation.

I, the undersigned applicant or authorized representative, or if a corporation, a responsible corporate officer, declare under

the penalties of perjury that I have examined this application and attachments and to the best of my knowledge the facts

set forth are true and correct, and that the requirements hereunder will be carried out in accordance with the laws of the

State of Oklahoma and the Rules and Regulations of the Oklahoma Tax Commission. I further acknowledge and agree to

follow the conditions cited herein and I am advised the misuse of the Direct Payment Permit or noncompliance with these

conditions may result in the cancellation of the Direct Payment Permit.

Type or print Name and Title: ________________________________________________________________________

Sign Name: _____________________________________________________ Date: __________________________

1

1