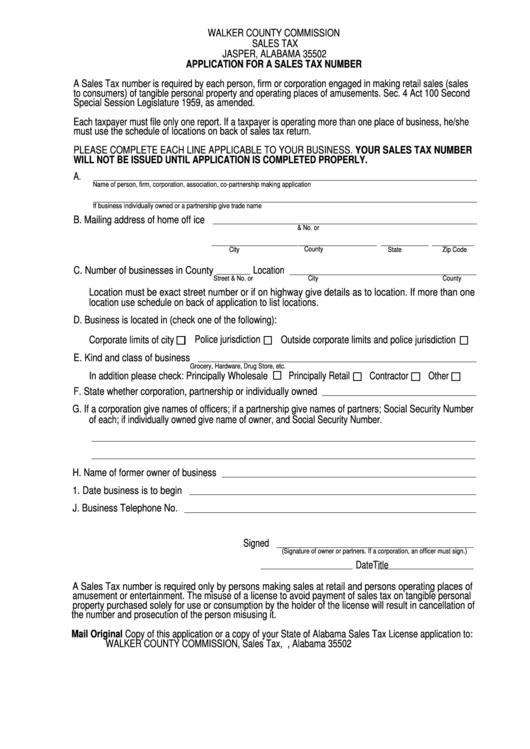

WALKER COUNTY COMMISSION

SALES TAX

JASPER, ALABAMA 35502

APPLICATION FOR A SALES TAX NUMBER

A Sales Tax number is required by each person, firm or corporation engaged in making retail sales (sales

to consumers) of tangible personal property and operating places of amusements. Sec. 4 Act 100 Second

Special Session Legislature 1959, as amended.

Each taxpayer must file only one report. If a taxpayer is operating more than one place of business, he/she

must use the schedule of locations on back of sales tax return.

PLEASE COMPLETE EACH LINE APPLICABLE TO YOUR BUSINESS. YOUR SALES TAX NUMBER

WILL NOT BE ISSUED UNTIL APPLICATION IS COMPLETED PROPERLY.

A.

Name of person, firm, corporation, association, co-partnership making application

If business individually owned or a partnership give trade name

B. Mailing address of home off ice

P.O. Box or Street & No. or R.F.D.

City

County

State

Zip Code

Location

C. Number of businesses in County

City

Street & No. or R.F.D.

County

Location must be exact street number or if on highway give details as to location. If more than one

location use schedule on back of application to list locations.

D. Business is located in (check one of the following):

Police jurisdiction

Outside corporate limits and police jurisdiction

Corporate limits of city

E. Kind and class of business

Grocery, Hardware, Drug Store, etc.

Principally Retail

In addition please check: Principally Wholesale

Contractor

Other

F. State whether corporation, partnership or individually owned

G. If a corporation give names of officers; if a partnership give names of partners; Social Security Number

of each; if individually owned give name of owner, and Social Security Number.

H. Name of former owner of business

1. Date business is to begin

J. Business Telephone No.

Signed

(Signature of owner or partners. If a corporation, an officer must sign.)

Title

Date

A Sales Tax number is required only by persons making sales at retail and persons operating places of

amusement or entertainment. The misuse of a license to avoid payment of sales tax on tangible personal

property purchased solely for use or consumption by the holder of the license will result in cancellation of

the number and prosecution of the person misusing it.

Mail Original Copy of this application or a copy of your State of Alabama Sales Tax License application to:

WALKER COUNTY COMMISSION, Sales Tax, P.O. Box 1447 - Jasper, Alabama 35502

1

1 2

2