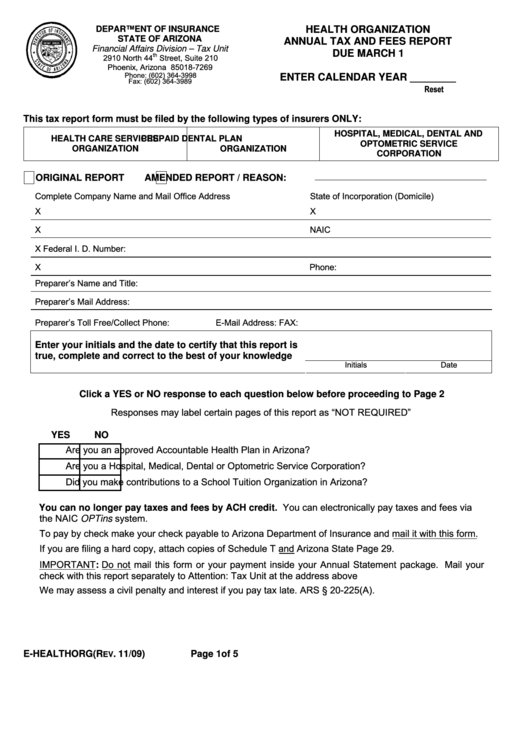

HEALTH ORGANIZATION

DEPARTMENT OF INSURANCE

STATE OF ARIZONA

ANNUAL TAX AND FEES REPORT

Financial Affairs Division – Tax Unit

DUE MARCH 1

th

2910 North 44

Street, Suite 210

Phoenix, Arizona 85018-7269

Phone: (602) 364-3998

ENTER CALENDAR YEAR ________

Fax: (602) 364-3989

Reset

This tax report form must be filed by the following types of insurers ONLY:

HOSPITAL, MEDICAL, DENTAL AND

HEALTH CARE SERVICES

PREPAID DENTAL PLAN

OPTOMETRIC SERVICE

ORGANIZATION

ORGANIZATION

CORPORATION

ORIGINAL REPORT

AMENDED REPORT / REASON:

Complete Company Name and Mail Office Address

State of Incorporation (Domicile)

X

X

X

NAIC Number:

X

Federal I. D. Number:

X

Phone:

Preparer’s Name and Title:

Preparer’s Mail Address:

Preparer’s Toll Free/Collect Phone:

E-Mail Address:

FAX:

Enter your initials and the date to certify that this report is

true, complete and correct to the best of your knowledge

Initials

Date

Click a YES or NO response to each question below before proceeding to Page 2

Responses may label certain pages of this report as “NOT REQUIRED”

YES

NO

Are you an approved Accountable Health Plan in Arizona?

Are you a Hospital, Medical, Dental or Optometric Service Corporation?

Did you make contributions to a School Tuition Organization in Arizona?

You can no longer pay taxes and fees by ACH credit. You can electronically pay taxes and fees via

the NAIC OPTins system.

To pay by check make your check payable to Arizona Department of Insurance and mail it with this form.

If you are filing a hard copy, attach copies of Schedule T and Arizona State Page 29.

IMPORTANT: Do not mail this form or your payment inside your Annual Statement package. Mail your

check with this report separately to Attention: Tax Unit at the address above

We may assess a civil penalty and interest if you pay tax late. ARS § 20-225(A).

E-HEALTHORG (R

. 11/09)

Page 1of 5

EV

1

1 2

2 3

3 4

4 5

5