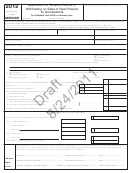

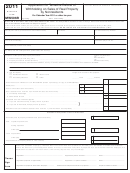

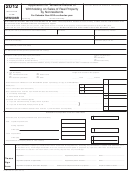

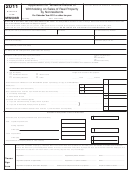

Form Wv/nrer - Application For Early Refund Of Withholding On Sales Of Real Property By Nonresidents

ADVERTISEMENT

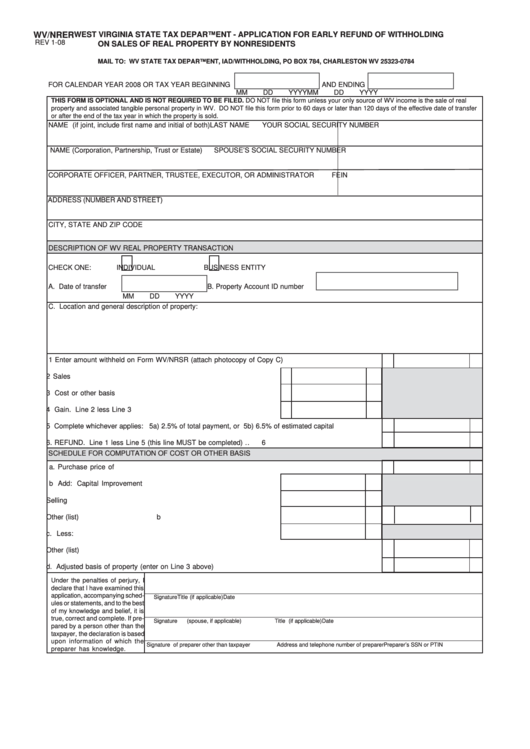

WV/NRER

WEST VIRGINIA STATE TAX DEPARTMENT - APPLICATION FOR EARLY REFUND OF WITHHOLDING

REV 1-08

ON SALES OF REAL PROPERTY BY NONRESIDENTS

MAIL TO: WV STATE TAX DEPARTMENT, IAD/WITHHOLDING, PO BOX 784, CHARLESTON WV 25323-0784

FOR CALENDAR YEAR 2008 OR TAX YEAR BEGINNING

AND ENDING

MM

DD

YYYY

MM

DD

YYYY

THIS FORM IS OPTIONAL AND IS NOT REQUIRED TO BE FILED. DO NOT file this form unless your only source of WV income is the sale of real

property and associated tangible personal property in WV. DO NOT file this form prior to 60 days or later than 120 days of the effective date of transfer

or after the end of the tax year in which the property is sold.

NAME (if joint, include first name and initial of both)

LAST NAME

YOUR SOCIAL SECURITY NUMBER

NAME (Corporation, Partnership, Trust or Estate)

SPOUSE’S SOCIAL SECURITY NUMBER

CORPORATE OFFICER, PARTNER, TRUSTEE, EXECUTOR, OR ADMINISTRATOR

FEIN

ADDRESS (NUMBER AND STREET)

CITY, STATE AND ZIP CODE

DESCRIPTION OF WV REAL PROPERTY TRANSACTION

CHECK ONE:

INDIVIDUAL

BUSINESS ENTITY

A. Date of transfer

B. Property Account ID number

MM

DD

YYYY

C. Location and general description of property:

1 Enter amount withheld on Form WV/NRSR (attach photocopy of Copy C).................................................

1

2 Sales price..............................................................................................

2

3 Cost or other basis ...............................................................................

3

4 Gain. Line 2 less Line 3 ......................................................................

4

5 Complete whichever applies: 5a) 2.5% of total payment, or 5b) 6.5% of estimated capital gain............

5

6. REFUND. Line 1 less Line 5 (this line MUST be completed)....................................................................

6

SCHEDULE FOR COMPUTATION OF COST OR OTHER BASIS

a. Purchase price of property.........................................................................................................................

a

b Add: Capital Improvements....................................................................

Selling expenses..........................................................................

Other (list)...................................................................................

b

c. Less: Depreciation..............................................................................

Other (list)....................................................................................................................................

c

d. Adjusted basis of property (enter on Line 3 above)...............................................................................

d

Under the penalties of perjury, I

declare that I have examined this

application, accompanying sched-

Signature

Title (if applicable)

Date

ules or statements, and to the best

of my knowledge and belief, it is

true, correct and complete. If pre-

Signature

(spouse, if applicable)

Title (if applicable)

Date

pared by a person other than the

taxpayer, the declaration is based

upon information of which the

Signature of preparer other than taxpayer

Address and telephone number of preparer

Preparer’s SSN or PTIN

preparer has knowledge.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2