Department of Insurance

INSTALLMENT TAX REPORT

State of Arizona

Reset

YEAR: ______

Financial Affairs Division – Tax Unit

2910 North 44th Street, Suite 210

ORIGINAL REPORT

TC 01

Phoenix, AZ 85018-7269

Telephone: (602) 364-3246

SUPPLEMENTAL REPORT

TC 02

Facsimile: (602) 364-3989

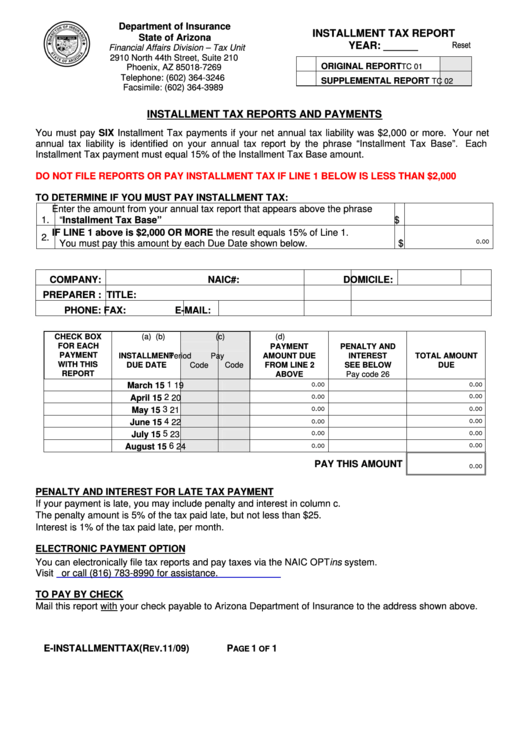

INSTALLMENT TAX REPORTS AND PAYMENTS

You must pay SIX Installment Tax payments if your net annual tax liability was $2,000 or more. Your net

annual tax liability is identified on your annual tax report by the phrase “Installment Tax Base”. Each

Installment Tax payment must equal 15% of the Installment Tax Base amount.

DO NOT FILE REPORTS OR PAY INSTALLMENT TAX IF LINE 1 BELOW IS LESS THAN $2,000

TO DETERMINE IF YOU MUST PAY INSTALLMENT TAX:

Enter the amount from your annual tax report that appears above the phrase

1.

“Installment Tax Base”

$

IF LINE 1 above is $2,000 OR MORE the result equals 15% of Line 1.

2.

0.00

You must pay this amount by each Due Date shown below.

$

COMPANY:

NAIC#:

DOMICILE:

PREPARER :

TITLE:

PHONE:

FAX:

E-MAIL:

CHECK BOX

(a)

(b)

(c)

(d)

FOR EACH

PAYMENT

PENALTY AND

PAYMENT

INSTALLMENT

Period

Pay

AMOUNT DUE

INTEREST

TOTAL AMOUNT

WITH THIS

DUE DATE

Code

Code

FROM LINE 2

SEE BELOW

DUE

REPORT

ABOVE

Pay code 26

0.00

0.00

1

March 15

19

0.00

0.00

2

April 15

20

0.00

0.00

3

May 15

21

0.00

0.00

4

June 15

22

0.00

0.00

5

July 15

23

0.00

0.00

6

August 15

24

PAY THIS AMOUNT

0.00

PENALTY AND INTEREST FOR LATE TAX PAYMENT

If your payment is late, you may include penalty and interest in column c.

The penalty amount is 5% of the tax paid late, but not less than $25.

Interest is 1% of the tax paid late, per month.

ELECTRONIC PAYMENT OPTION

You can electronically file tax reports and pay taxes via the NAIC OPTins system.

Visit

or call (816) 783-8990 for assistance.

TO PAY BY CHECK

Mail this report with your check payable to Arizona Department of Insurance to the address shown above.

E-INSTALLMENT TAX (R

. 11/09)

P

1

1

EV

AGE

OF

1

1