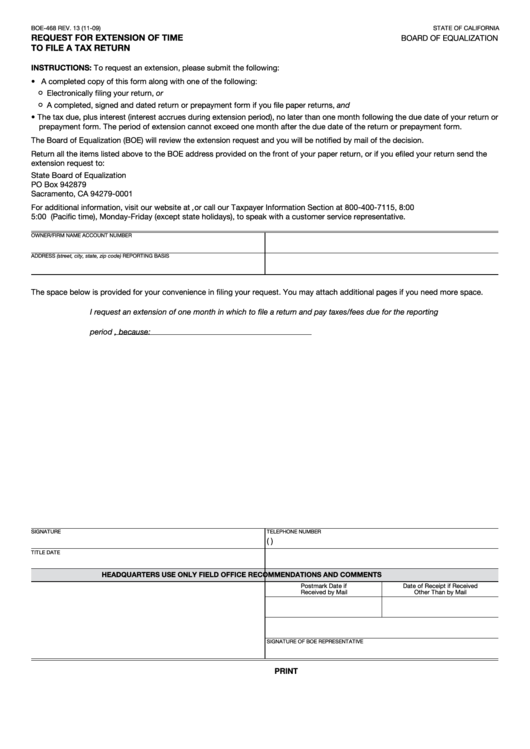

BOE-468 REV. 13 (11-09)

STATE OF CALIFORNIA

REQUEST FOR EXTENSION OF TIME

BOARD OF EQUALIZATION

TO FILE A TAX RETURN

INSTRUCTIONS: To request an extension, please submit the following:

• A completed copy of this form along with one of the following:

Electronically filing your return, or

)

A completed, signed and dated return or prepayment form if you file paper returns, and

)

• The tax due, plus interest (interest accrues during extension period), no later than one month following the due date of your return or

prepayment form. The period of extension cannot exceed one month after the due date of the return or prepayment form.

The Board of Equalization (BOE) will review the extension request and you will be notified by mail of the decision.

Return all the items listed above to the BOE address provided on the front of your paper return, or if you efiled your return send the

extension request to:

State Board of Equalization

PO Box 942879

Sacramento, CA 94279-0001

For additional information, visit our website at , or call our Taxpayer Information Section at 800-400-7115, 8:00 a.m. to

5:00 p.m. (Pacific time), Monday-Friday (except state holidays), to speak with a customer service representative.

OWNER/FIRM NAME

ACCOUNT NUMBER

ADDRESS (street, city, state, zip code)

REPORTING BASIS

The space below is provided for your convenience in filing your request. You may attach additional pages if you need more space.

I request an extension of one month in which to file a return and pay taxes/fees due for the reporting

period

, because:

SIGNATURE

TELEPHONE NUMBER

(

)

TITLE

DATE

HEADQUARTERS USE ONLY

FIELD OFFICE RECOMMENDATIONS AND COMMENTS

Postmark Date if

Date of Receipt if Received

Received by Mail

Other Than by Mail

SIGNATURE OF BOE REPRESENTATIVE

CLEAR

PRINT

1

1