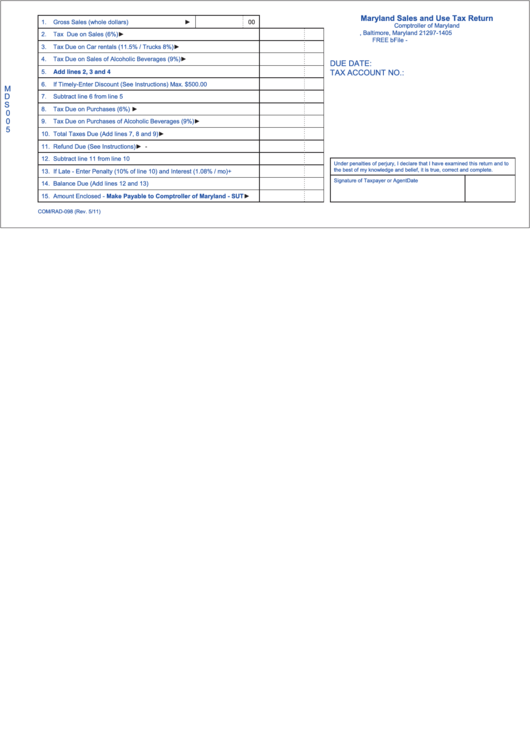

Form Com/rad-098 - Maryland Sales And Use Tax Return

ADVERTISEMENT

Maryland Sales and Use Tax Return

1.

Gross Sales (whole dollars)

►

00

Comptroller of Maryland

P.O. Box 17405, Baltimore, Maryland 21297-1405

2.

Tax Due on Sales (6%)

►

FREE bFile -

3.

Tax Due on Car rentals (11.5% / Trucks 8%)

►

4.

Tax Due on Sales of Alcoholic Beverages (9%)

►

DUE DATE:

5.

TAX ACCOUNT NO.:

Add lines 2, 3 and 4

6.

If Timely-Enter Discount (See Instructions) Max. $500.00

M

D

7.

Subtract line 6 from line 5

S

8.

Tax Due on Purchases (6%)

►

0

0

9.

Tax Due on Purchases of Alcoholic Beverages (9%)

►

5

10. Total Taxes Due (Add lines 7, 8 and 9)

►

11. Refund Due (See Instructions)

►

-

12. Subtract line 11 from line 10

Under penalties of perjury, I declare that I have examined this return and to

the best of my knowledge and belief, it is true, correct and complete.

13. If Late - Enter Penalty (10% of line 10) and Interest (1.08% / mo)

+

Signature of Taxpayer or Agent

Date

14. Balance Due (Add lines 12 and 13)

15. Amount Enclosed - Make Payable to Comptroller of Maryland - SUT

►

COM/RAD-098

(Rev. 5/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1