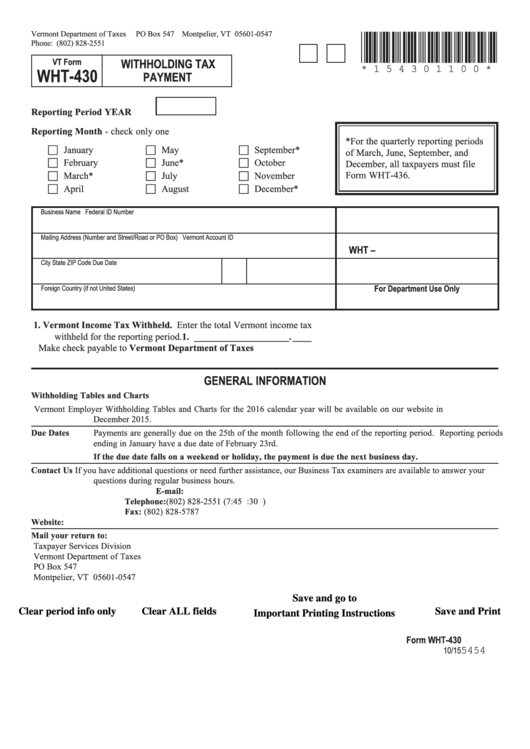

Vermont Department of Taxes

PO Box 547 Montpelier, VT 05601-0547

*154301100*

Phone: (802) 828-2551

VT Form

WITHHOLDING TAX

* 1 5 4 3 0 1 1 0 0 *

WHT-430

PAYMENT

Reporting Period YEAR . . . .

Reporting Month - check only one

*For the quarterly reporting periods

c January

c May

c September*

of March, June, September, and

c February

c June*

c October

December, all taxpayers must file

c March*

c July

c November

Form WHT-436 .

c April

c August

c December*

Business Name

Federal ID Number

Mailing Address (Number and Street/Road or PO Box)

Vermont Account ID

WHT –

City

State

ZIP Code

Due Date

For Department Use Only

Foreign Country (if not United States)

1. Vermont Income Tax Withheld. Enter the total Vermont income tax

withheld for the reporting period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. ____________________ . ____

Make check payable to Vermont Department of Taxes

GENERAL INFORMATION

Withholding Tables and Charts

Vermont Employer Withholding Tables and Charts for the 2016 calendar year will be available on our website in

December 2015 .

Due Dates

Payments are generally due on the 25th of the month following the end of the reporting period . Reporting periods

ending in January have a due date of February 23rd .

If the due date falls on a weekend or holiday, the payment is due the next business day.

Contact Us

If you have additional questions or need further assistance, our Business Tax examiners are available to answer your

questions during regular business hours .

E-mail:

tax.business@vermont.gov

Telephone: (802) 828-2551 (7:45 a .m . - 4:30 p .m .)

Fax:

(802) 828-5787

Website:

Mail your return to:

Taxpayer Services Division

Vermont Department of Taxes

PO Box 547

Montpelier, VT 05601-0547

Save and go to

Clear period info only

Clear ALL fields

Save and Print

Important Printing Instructions

Form WHT-430

5454

10/15

1

1