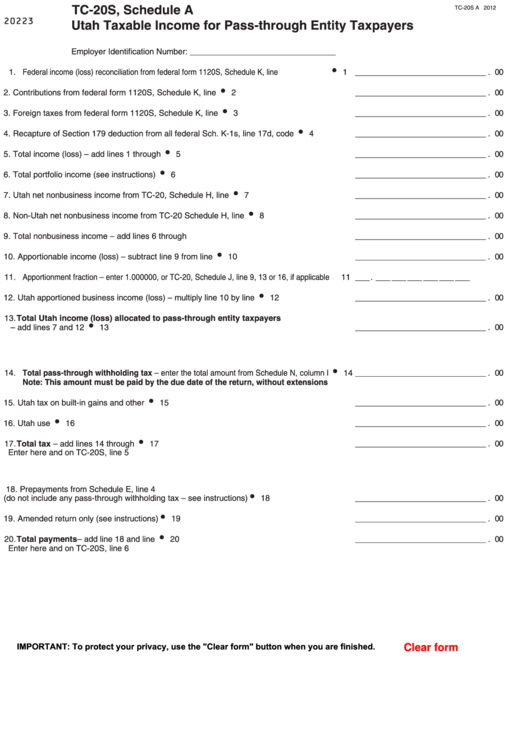

TC-20S, Schedule A

TC-20S A 2012

20223

Utah Taxable Income for Pass-through Entity Taxpayers

Employer Identification Number: __ __________ __ ___ __

1. Federal income (loss) reconciliation from federal form 1120S, Schedule K, line 18 .................

1 ___ __ __ __ ___ _ _ __ _ . 00

2. Contributions from federal form 1120S, Schedule K, line 12a ....................................

2 _ __ ___ __ __ __ _ _ _ __ . 00

3. Foreign taxes from federal form 1120S, Schedule K, line 14l .....................................

3 _ __ ___ __ __ __ _ _ _ __ . 00

4. Recapture of Section 179 deduction from all federal Sch. K-1s, line 17d, code L ......

4 _ ___ __ __ __ ___ _ _ _ _ . 00

5. Total income (loss) – add lines 1 through 4 ................................................................

5 __ __ ___ __ __ _ __ _ _ _ . 00

6. Total portfolio income (see instructions) .....................................................................

6 _ __ ___ __ __ __ _ _ _ __ . 00

7. Utah net nonbusiness income from TC-20, Schedule H, line 14 ................................

7 _ ___ __ __ __ ___ _ _ _ _ . 00

8. Non-Utah net nonbusiness income from TC-20 Schedule H, line 28..........................

8 _ ___ __ __ __ ___ _ _ _ _ . 00

9. Total nonbusiness income – add lines 6 through 8 .....................................................

9 __ __ ___ __ __ _ __ _ _ _ . 00

10. Apportionable income (loss) – subtract line 9 from line 5 ...........................................

10 _ ___ __ __ __ ___ _ _ _ _ . 00

11. Apportionment fraction – enter 1.000000, or TC-20, Schedule J, line 9, 13 or 16, if applicable

11 __ . __ __ __ __ __ __

12. Utah apportioned business income (loss) – multiply line 10 by line 11.......................

12 _ ___ __ __ __ ___ _ _ _ _ . 00

13. Total Utah income (loss) allocated to pass-through entity taxpayers

– add lines 7 and 12 ..................................................................................................

13 ___ __ __ __ ___ _ _ __ _ . 00

14. Total pass-through withholding tax – enter the total amount from Schedule N, column I

14 __ __ __ ___ __ __ _ _ _ _ . 00

Note: This amount must be paid by the due date of the return, without extensions

15. Utah tax on built-in gains and other gains...................................................................

15 _ __ __ ___ __ __ _ _ _ __ . 00

16. Utah use tax................................................................................................................

16 ___ __ __ __ ___ _ _ __ _ . 00

17. Total tax – add lines 14 through 16............................................................................

17 _ __ __ __ ___ __ _ _ _ _ _ . 00

Enter here and on TC-20S, line 5

18. Prepayments from Schedule E, line 4

(do not include any pass-through withholding tax – see instructions).........................

18 _ __ ___ __ __ __ _ _ _ __ . 00

19. Amended return only (see instructions) ......................................................................

19 __ __ ___ __ __ _ __ _ _ _ . 00

20. Total payments – add line 18 and line 19..................................................................

20 _ __ __ __ ___ __ _ _ _ _ _ . 00

Enter here and on TC-20S, line 6

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2