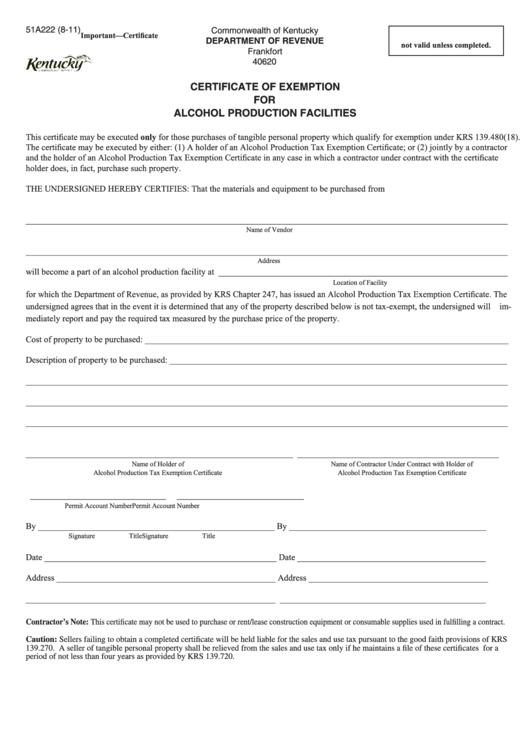

Form 51a222 - Certificate Of Exemption For Alcohol Production Facilities

ADVERTISEMENT

51A222 (8-11)

Commonwealth of Kentucky

Important—Certificate

DEPARTMENT OF REVENUE

not valid unless completed.

Frankfort

40620

CERTIFICATE OF EXEMPTION

FOR

ALCOHOL PRODUCTION FACILITIES

This certificate may be executed only for those purchases of tangible personal property which qualify for exemption under KRS 139.480(18).

The certificate may be executed by either: (1) A holder of an Alcohol Production Tax Exemption Certificate; or (2) jointly by a contractor

and the holder of an Alcohol Production Tax Exemption Certificate in any case in which a contractor under contract with the certificate

holder does, in fact, purchase such property.

THE UNDERSIGNED HEREBY CERTIFIES: That the materials and equipment to be purchased from

______________________________________________________________________________________________________________

Name of Vendor

______________________________________________________________________________________________________________

Address

will become a part of an alcohol production facility at __________________________________________________________________

Location of Facility

for which the Department of Revenue, as provided by KRS Chapter 247, has issued an Alcohol Production Tax Exemption Certificate. The

undersigned agrees that in the event it is determined that any of the property described below is not tax-exempt, the undersigned will im-

mediately report and pay the required tax measured by the purchase price of the property.

Cost of property to be purchased: ___________________________________________________________________________________

Description of property to be purchased: _____________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

_____________________________________________________________

______________________________________________

Name of Holder of

Name of Contractor Under Contract with Holder of

Alcohol Production Tax Exemption Certificate

Alcohol Production Tax Exemption Certificate

_______________________________

_____________________________

Permit Account Number

Permit Account Number

By ______________________________________________________

By _____________________________________________

Signature

Title

Signature

Title

Date _____________________________________________________

Date ___________________________________________

Address __________________________________________________

Address _________________________________________

_________________________________________________________

_______________________________________________

Contractor’s Note: This certificate may not be used to purchase or rent/lease construction equipment or consumable supplies used in fulfilling a contract.

Caution: Sellers failing to obtain a completed certificate will be held liable for the sales and use tax pursuant to the good faith provisions of KRS

139.270. A seller of tangible personal property shall be relieved from the sales and use tax only if he maintains a file of these certificates for a

period of not less than four years as provided by KRS 139.720.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1