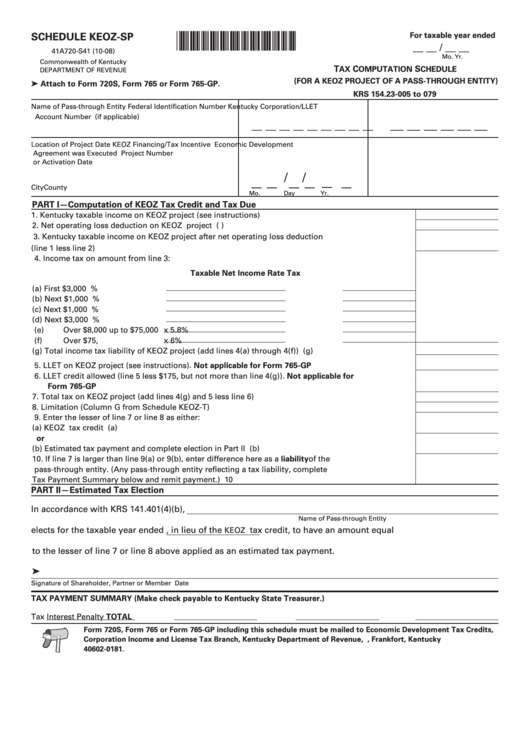

Schedule Keoz-Sp - Tax Computation Schedule (For A Keoz Project Of A Pass-Through Entity)

ADVERTISEMENT

SCHEDULE KEOZ-SP

For taxable year ended

*0800010239*

__ __ / __ __

41A720-S41 (10-08)

Mo.

Yr.

Commonwealth of Kentucky

T

C

S

AX

OMPUTATION

CHEDULE

DEPARTMENT OF REVENUE

(FOR A KEOZ PROJECT OF A PASS-THROUGH ENTITY)

➤ Attach to Form 720S, Form 765 or Form 765-GP .

KRS 154.23-005 to 079

Name of Pass-through Entity

Federal Identification Number

Kentucky Corporation/LLET

Account Number (if applicable)

__ __ __ __ __ __

__ __ __ __ __ __ __ __ __

Location of Project

Date KEOZ Financing/Tax Incentive

Economic Development

Agreement was Executed

Project Number

or Activation Date

/

/

City

County

Mo.

Day

Yr.

PART I—Computation of KEOZ Tax Credit and Tax Due

1. Kentucky taxable income on KEOZ project (see instructions) .................................................................1

2. Net operating loss deduction on KEOZ project .......................................................................................2 (

)

3. Kentucky taxable income on KEOZ project after net operating loss deduction

(line 1 less line 2) .........................................................................................................................................3

4. Income tax on amount from line 3:

Taxable Net Income

Rate

Tax

(a) First $3,000 ........................

x

2%

(b) Next $1,000 ........................

x

3%

(c) Next $1,000 ........................

x

4%

(d) Next $3,000 ........................

x

5%

(e) Over $8,000 up to $75,000

x

5.8%

(f) Over $75,000.......................

x

6%

(g) Total income tax liability of KEOZ project (add lines 4(a) through 4(f)) ...................................... 4(g)

5. LLET on KEOZ project (see instructions). Not applicable for Form 765-GP ............................................5

6. LLET credit allowed (line 5 less $175, but not more than line 4(g)). Not applicable for

Form 765-GP ................................................................................................................................................6

7. Total tax on KEOZ project (add lines 4(g) and 5 less line 6) .....................................................................7

8. Limitation (Column G from Schedule KEOZ-T) .........................................................................................8

9. Enter the lesser of line 7 or line 8 as either:

(a) KEOZ tax credit ............................................................................................................................... 9(a)

or

(b) Estimated tax payment and complete election in Part II .............................................................. 9(b)

10. If line 7 is larger than line 9(a) or 9(b), enter difference here as a liability of the

pass-through entity. (Any pass-through entity reflecting a tax liability, complete

Tax Payment Summary below and remit payment.) .............................................................................. 10

PART II—Estimated Tax Election

In accordance with KRS 141.401(4)(b),

Name of Pass-through Entity

elects for the taxable year ended

, in lieu of the

tax credit, to have an amount equal

KEOZ

to the lesser of line 7 or line 8 above applied as an estimated tax payment.

➤

Signature of Shareholder, Partner or Member

Date

TAX PAYMENT SUMMARY (Make check payable to Kentucky State Treasurer.)

Tax

Interest

Penalty

TOTAL

Form 720S, Form 765 or Form 765-GP including this schedule must be mailed to Economic Development Tax Credits,

Corporation Income and License Tax Branch, Kentucky Department of Revenue, P .O. Box 181, Frankfort, Kentucky

40602-0181.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1