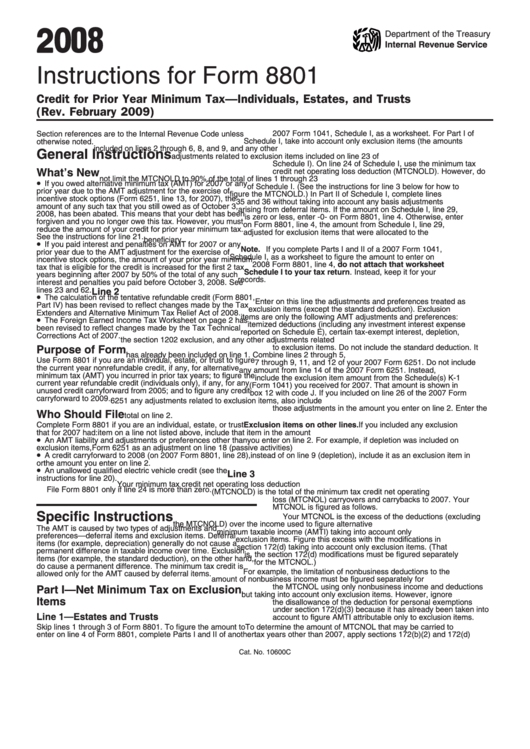

Instructions For Form 8801 - Credit For Prior Year Minimum Tax - Individuals, Estates, And Trusts - 2008

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Form 8801

Credit for Prior Year Minimum Tax—Individuals, Estates, and Trusts

(Rev. February 2009)

2007 Form 1041, Schedule I, as a worksheet. For Part I of

Section references are to the Internal Revenue Code unless

Schedule I, take into account only exclusion items (the amounts

otherwise noted.

included on lines 2 through 6, 8, and 9, and any other

General Instructions

adjustments related to exclusion items included on line 23 of

Schedule I). On line 24 of Schedule I, use the minimum tax

credit net operating loss deduction (MTCNOLD). However, do

What’s New

not limit the MTCNOLD to 90% of the total of lines 1 through 23

•

If you owed alternative minimum tax (AMT) for 2007 or any

of Schedule I. (See the instructions for line 3 below for how to

prior year due to the AMT adjustment for the exercise of

figure the MTCNOLD.) In Part II of Schedule I, complete lines

incentive stock options (Form 6251, line 13, for 2007), the

35 and 36 without taking into account any basis adjustments

amount of any such tax that you still owed as of October 3,

arising from deferral items. If the amount on Schedule I, line 29,

2008, has been abated. This means that your debt has been

is zero or less, enter -0- on Form 8801, line 4. Otherwise, enter

forgiven and you no longer owe this tax. However, you must

on Form 8801, line 4, the amount from Schedule I, line 29,

reduce the amount of your credit for prior year minimum tax.

adjusted for exclusion items that were allocated to the

See the instructions for line 21.

beneficiary.

•

If you paid interest and penalties on AMT for 2007 or any

Note. If you complete Parts I and II of a 2007 Form 1041,

prior year due to the AMT adjustment for the exercise of

Schedule I, as a worksheet to figure the amount to enter on

incentive stock options, the amount of your prior year minimum

2008 Form 8801, line 4, do not attach that worksheet

tax that is eligible for the credit is increased for the first 2 tax

Schedule I to your tax return. Instead, keep it for your

years beginning after 2007 by 50% of the total of any such

records.

interest and penalties you paid before October 3, 2008. See

lines 23 and 62.

Line 2

•

The calculation of the tentative refundable credit (Form 8801,

Enter on this line the adjustments and preferences treated as

Part IV) has been revised to reflect changes made by the Tax

exclusion items (except the standard deduction). Exclusion

Extenders and Alternative Minimum Tax Relief Act of 2008.

items are only the following AMT adjustments and preferences:

•

The Foreign Earned Income Tax Worksheet on page 2 has

itemized deductions (including any investment interest expense

been revised to reflect changes made by the Tax Technical

reported on Schedule E), certain tax-exempt interest, depletion,

Corrections Act of 2007.

the section 1202 exclusion, and any other adjustments related

to exclusion items. Do not include the standard deduction. It

Purpose of Form

has already been included on line 1. Combine lines 2 through 5,

Use Form 8801 if you are an individual, estate, or trust to figure

7 through 9, 11, and 12 of your 2007 Form 6251. Do not include

the current year nonrefundable credit, if any, for alternative

any amount from line 14 of the 2007 Form 6251. Instead,

minimum tax (AMT) you incurred in prior tax years; to figure the

include the exclusion item amount from the Schedule(s) K-1

current year refundable credit (individuals only), if any, for any

(Form 1041) you received for 2007. That amount is shown in

unused credit carryforward from 2005; and to figure any credit

box 12 with code J. If you included on line 26 of the 2007 Form

carryforward to 2009.

6251 any adjustments related to exclusion items, also include

those adjustments in the amount you enter on line 2. Enter the

Who Should File

total on line 2.

Complete Form 8801 if you are an individual, estate, or trust

Exclusion items on other lines. If you included any exclusion

that for 2007 had:

item on a line not listed above, include that item in the amount

•

An AMT liability and adjustments or preferences other than

you enter on line 2. For example, if depletion was included on

exclusion items,

Form 6251 as an adjustment on line 18 (passive activities)

•

A credit carryforward to 2008 (on 2007 Form 8801, line 28),

instead of on line 9 (depletion), include it as an exclusion item in

or

the amount you enter on line 2.

•

An unallowed qualified electric vehicle credit (see the

Line 3

instructions for line 20).

Your minimum tax credit net operating loss deduction

File Form 8801 only if line 24 is more than zero.

(MTCNOLD) is the total of the minimum tax credit net operating

loss (MTCNOL) carryovers and carrybacks to 2007. Your

MTCNOL is figured as follows.

Specific Instructions

Your MTCNOL is the excess of the deductions (excluding

the MTCNOLD) over the income used to figure alternative

The AMT is caused by two types of adjustments and

minimum taxable income (AMTI) taking into account only

preferences — deferral items and exclusion items. Deferral

exclusion items. Figure this excess with the modifications in

items (for example, depreciation) generally do not cause a

section 172(d) taking into account only exclusion items. (That

permanent difference in taxable income over time. Exclusion

is, the section 172(d) modifications must be figured separately

items (for example, the standard deduction), on the other hand,

for the MTCNOL.)

do cause a permanent difference. The minimum tax credit is

For example, the limitation of nonbusiness deductions to the

allowed only for the AMT caused by deferral items.

amount of nonbusiness income must be figured separately for

the MTCNOL using only nonbusiness income and deductions

Part I—Net Minimum Tax on Exclusion

but taking into account only exclusion items. However, ignore

Items

the disallowance of the deduction for personal exemptions

under section 172(d)(3) because it has already been taken into

Line 1—Estates and Trusts

account to figure AMTI attributable only to exclusion items.

Skip lines 1 through 3 of Form 8801. To figure the amount to

To determine the amount of MTCNOL that may be carried to

enter on line 4 of Form 8801, complete Parts I and II of another

tax years other than 2007, apply sections 172(b)(2) and 172(d)

Cat. No. 10600C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4