Clear This Page

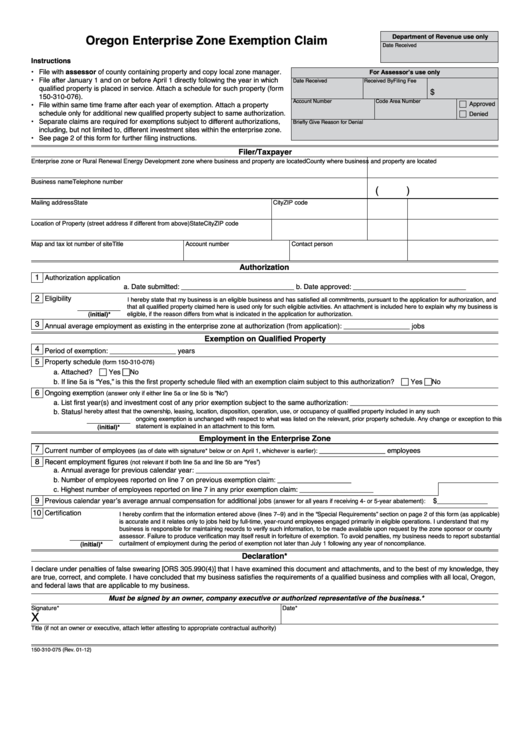

Oregon Enterprise Zone Exemption Claim

Department of Revenue use only

Date Received

Instructions

• File with assessor of county containing property and copy local zone manager.

For Assessor’s use only

• File after January 1 and on or before April 1 directly following the year in which

Date Received

Received By

Filing Fee

qualified property is placed in service. Attach a schedule for such property (form

$

150-310-076).

Account Number

Code Area Number

Approved

• File within same time frame after each year of exemption. Attach a property

schedule only for additional new qualified property subject to same authorization.

Denied

• Separate claims are required for exemptions subject to different authorizations,

Briefly Give Reason for Denial

including, but not limited to, different investment sites within the enterprise zone.

• See page 2 of this form for further filing instructions.

Filer/Taxpayer

Enterprise zone or Rural Renewal Energy Development zone where business and property are located

County where business and property are located

Business name

Telephone number

(

)

Mailing address

City

State

ZIP code

Location of Property (street address if different from above)

City

State

ZIP code

Map and tax lot number of site

Account number

Contact person

Title

Authorization

1

Authorization application

a. Date submitted: _____________________________

b. Date approved: _____________________________

2

Eligibility

I hereby state that my business is an eligible business and has satisfied all commitments, pursuant to the application for authorization, and

that all qualified property claimed here is used only for such eligible activities. An attachment is included here to explain why my business is

eligible, if the reason differs from what is indicated in the application for authorization.

(initial)*

3

Annual average employment as existing in the enterprise zone at authorization (from application): _________________ jobs

Exemption on Qualified Property

4

Period of exemption: _________________ years

5

Property schedule

(form 150-310-076)

a. Attached?

Yes

No

c

c

b. If line 5a is “Yes,” is this the first property schedule filed with an exemption claim subject to this authorization?

Yes

No

c

c

6

Ongoing exemption

(answer only if either line 5a or line 5b is “No”)

a. List first year(s) and investment cost of any prior exemption subject to the same authorization: ______________________________________

b. Status

I hereby attest that the ownership, leasing, location, disposition, operation, use, or occupancy of qualified property included in any such

ongoing exemption is unchanged with respect to what was listed on the relevant, prior property schedule. Any change or exception to this

statement is explained in an attachment to this form.

(initial)*

Employment in the Enterprise Zone

7

Current number of employees

_________________ employees

(as of date with signature* below or on April 1, whichever is earlier):

8

Recent employment figures

(not relevant if both line 5a and line 5b are “Yes”)

a. Annual average for previous calendar year: ___________________

b. Number of employees reported on line 7 on previous exemption claim: ___________________

c. Highest number of employees reported on line 7 in any prior exemption claim: ___________________

9

Previous calendar year’s average annual compensation for additional jobs

$_____________

(answer for all years if receiving 4- or 5-year abatement):

10

Certification

I hereby confirm that the information entered above (lines 7–9) and in the “Special Requirements” section on page 2 of this form (as applicable)

is accurate and it relates only to jobs held by full-time, year-round employees engaged primarily in eligible operations. I understand that my

business is responsible for maintaining records to verify such information, to be made available upon request by the zone sponsor or county

assessor. Failure to produce verification may itself result in forfeiture of exemption. To avoid penalties, my business needs to report substantial

curtailment of employment during the period of exemption not later than July 1 following any year of noncompliance.

(initial)*

Declaration*

I declare under penalties of false swearing [ORS 305.990(4)] that I have examined this document and attachments, and to the best of my knowledge, they

are true, correct, and complete. I have concluded that my business satisfies the requirements of a qualified business and complies with all local, Oregon,

and federal laws that are applicable to my business.

Must be signed by an owner, company executive or authorized representative of the business.*

Signature*

Date*

X

Title (if not an owner or executive, attach letter attesting to appropriate contractual authority)

150-310-075 (Rev. 01-12)

1

1 2

2