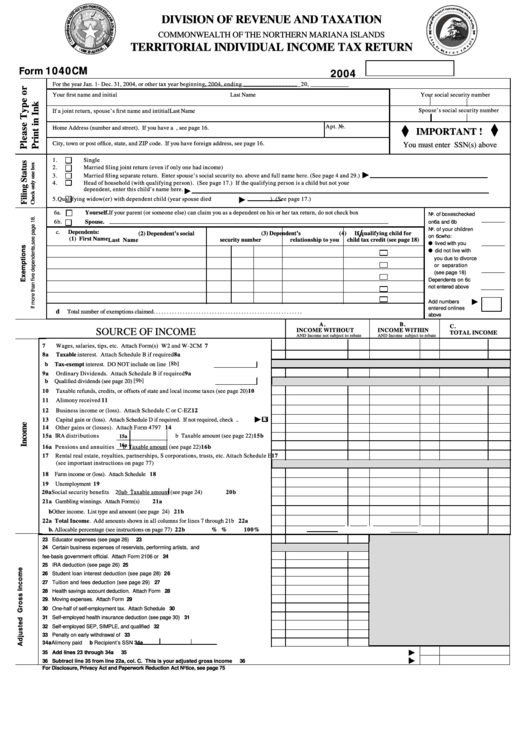

Form 1040cm - Territorial Individual Income Tax Return 2004

ADVERTISEMENT

DIVISION OF REVENUE AND TAXATION

COMMONWEALTH OF THE NORTHERN MARIANA ISLANDS

TERRITORIAL INDIVIDUAL INCOME TAX RETURN

1040CM

Form

2004

For the year Jan. 1- Dec. 31, 2004, or other tax year beginning

, 2004, ending __________________20, ____________

Your first name and initial

Last Name

Your social security number

Spouse’s social security number

If a joint return, spouse’s first name and intitial

Last Name

Apt. No.

Home Address (number and street). If you have a P.O. Box, see page 16.

IMPORTANT !

City, town or post office, state, and ZIP code. If you have foreign address, see page 16.

You must enter SSN(s) above

1.

Single

2.

Married filing joint return (even if only one had income)

3.

Married filing separate return. Enter spouse’s social security no. above and full name here. (See page 4 and 29.)

4.

Head of household (with qualifying person). (See page 17.) If the qualifying person is a child but not your

dependent, enter this child’s name here.

5.

Qualifying widow(er) with dependent child (year spouse died

) (See page 17.)

6a.

Yourself. If your parent (or someone else) can claim you as a dependent on his or her tax return, do not check box 6a...............

No. of boxeschecked

6b.

Spouse.

on6a and 6b

No. of your children

c.

Dependents:

/

(2) Dependent’s social

(3) Dependent’s

(4)

If qualifying child for

\

on 6cwho:

(1) First Name

Last Name

security number

relationship to you

child tax credit (see page 18)

Ž lived with you

Ž did not live with

you due to divorce

or separation

(see page 18)

Dependents on 6c

not entered above

Add numbers

entered onlines

d

Total number of exemptions claimed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ............................ . . . . . . . . . . . . . . . . . . . . . . . .

above

A.

B.

C.

INCOME WITHOUT

INCOME WITHIN

SOURCE OF INCOME

TOTAL INCOME

AND Income not subject to rebate

AND Income subject to rebate

7

Wages, salaries, tips, etc. Attach Form(s) W2 and W-2CM ..................................................

7

8a

Taxable interest. Attach Schedule B if required........................................................................

8a

Tax-exempt interest. DO NOT include on line 8a............................. [8b]

b

9a

Ordinary Dividends. Attach Schedule B if required.............................................................

9a

Qualified dividends (see page 20).......................................................... [9b]

b

10

Taxable refunds, credits, or offsets of state and local income taxes (see page 20)................

10

11

Alimony received................................................................................................................ ..............

11

12

Business income or (loss). Attach Schedule C or C-EZ.............................................................

12

13

Capital gain or (loss). Attach Schedule D if required. If not required, check here........

13

14

Other gains or (losses). Attach Form 4797 .................................................................................

14

15a IRA distributions

b Taxable amount (see page 22)

15b

15a

16a

16a Pensions and annuities

b Taxable amount (see page 22)

16b

17

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17

(see important instructions on page 77)

18

Farm income or (loss). Attach Schedule F.....................................................................................

18

19

Unemployment compensation..........................................................................................................

19

20a Social security benefits 20a

b Taxable amount (see page 24)

20b

21a Gambling winnings. Attach Form(s) W-2G................................................................................

21a

b Other income. List type and amount (see page 24)..................................................................

21b

22a Total Income. Add amounts shown in all columns for lines 7 through 21b .....................

22a

b. Allocable percentage (see instructions on page 77)..................................................................

22b

%

%

100%

23 Educator expenses (see page 26)........................................................................................................

23

24 Certain business expenses of reservists, performing artists, and

fee-basis government official. Attach Form 2106 or 2106-EZ............................................................. 24

25 IRA deduction (see page 26)....................................................................................................... 25

26 Student loan interest deduction (see page 28)............................................................................

26

27 Tuition and fees deduction (see page 29)...................................................................................

27

28 Health savings account deduction. Attach Form 8889......................................................................... 28

29. Moving expenses. Attach Form 3903.................................................................................................... 29

30 One-half of self-employment tax. Attach Schedule SE......................................................................... 30

31 Self-employed health insurance deduction (see page 30)...................................................................

31

32 Self-employed SEP, SIMPLE, and qualified plans................................................................................ 32

33 Penalty on early withdrawal of savings.................................................................................................

33

34a Alimony paid

b Recipient’s SSN

................................. 34a

35 Add lines 23 through 34a..........................................................................................................................................................................................................................

35

36 Subtract line 35 from line 22a, col. C. This is your adjusted gross income.................................................................................................................................

36

For Disclosure, Privacy Act and Paperwork Reduction Act Notice, see page 75

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4