Clear form

Print Form

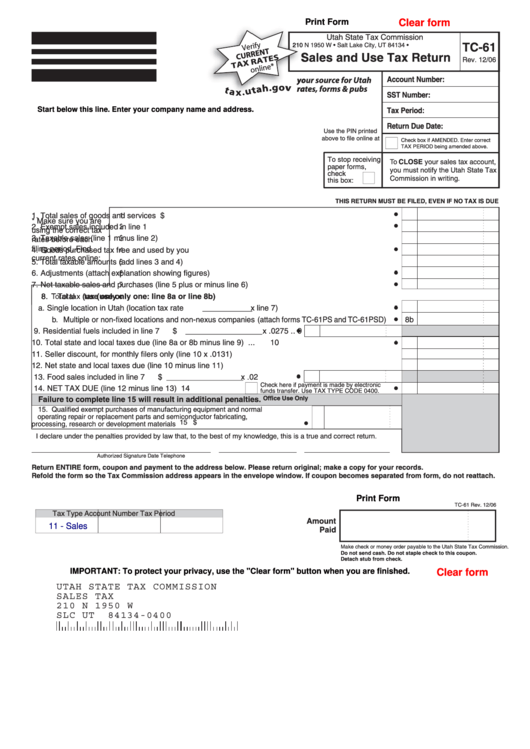

Utah State Tax Commission

210 N 1950 W • Salt Lake City, UT 84134 •

TC-61

Sales and Use Tax Return

Rev. 12/06

Account Number:

your source for Utah

rates, forms & pubs

SST Number:

Start below this line. Enter your company name and address.

Tax Period:

Return Due Date:

Use the PIN printed

above to file online at

Check box if AMENDED. Enter correct

utah.gov/salestax

TAX PERIOD being amended above.

To stop receiving

To CLOSE your sales tax account,

paper forms,

you must notify the Utah State Tax

check

Commission in writing.

this box:

THIS RETURN MUST BE FILED, EVEN IF NO TAX IS DUE

1. Total sales of goods and services ..................................................................

1

$

* Make sure you are

2. Exempt sales included in line 1 .......................................................................

2

using the correct tax

3. Taxable sales (line 1 minus line 2) .................................................................

3

rates before each

filing period. Find

4. Goods purchased tax free and used by you ..................................................

4

current rates online:

5. Total taxable amounts (add lines 3 and 4) .....................................................

5

tax.utah.gov/sales/

6. Adjustments (attach explanation showing figures) .........................................

6

rates.html

7. Net taxable sales and purchases (line 5 plus or minus line 6) .......................

7

8. Total tax (use only one: line 8a or line 8b)

a. Single location in Utah (location tax rate _________ x line 7) ..................................................

8a

b. Multiple or non-fixed locations and non-nexus companies (attach forms TC-61PS and TC-61PSD)

8b

9. Residential fuels included in line 7

$______________ x .0275 ..

9

10. Total state and local taxes due (line 8a or 8b minus line 9) ................................................................

10

11. Seller discount, for monthly filers only (line 10 x .0131) ....................................................................

11

12. Net state and local taxes due (line 10 minus line 11) ........................................................................

12

13. Food sales included in line 7

$______________ x .02 ..............

13

Check here if payment is made by electronic

14. NET TAX DUE (line 12 minus line 13)

14

funds transfer. Use TAX TYPE CODE 0400.

Office Use Only

Failure to complete line 15 will result in additional penalties.

15. Qualified exempt purchases of manufacturing equipment and normal

operating repair or replacement parts and semiconductor fabricating,

15 $

processing, research or development materials

...................................................

I declare under the penalties provided by law that, to the best of my knowledge, this is a true and correct return.

Authorized Signature

Date

Telephone

Return ENTIRE form, coupon and payment to the address below. Please return original; make a copy for your records.

Refold the form so the Tax Commission address appears in the envelope window. If coupon becomes separated from form, do not reattach.

Print Form

TC-61 Rev. 12/06

Tax Type

Account Number

Tax Period

Amount

11 - Sales

Paid

Make check or money order payable to the Utah State Tax Commission.

Do not send cash. Do not staple check to this coupon.

Detach stub from check.

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

UTAH STATE TAX COMMISSION

SALES TAX

210 N 1950 W

SLC UT

84134-0400

1

1