Clear Form

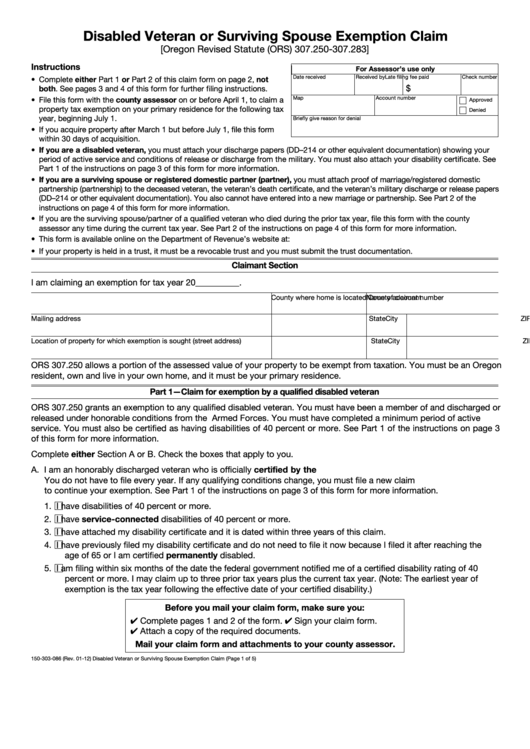

Disabled Veteran or Surviving Spouse Exemption Claim

[Oregon Revised Statute (ORS) 307.250-307.283]

Instructions

For Assessor’s use only

Date received

Received by

Late filing fee paid

Check number

• Complete either Part 1 or Part 2 of this claim form on page 2, not

$

both. See pages 3 and 4 of this form for further filing instructions.

Map

Account number

• File this form with the county assessor on or before April 1, to claim a

Approved

property tax exemption on your primary residence for the following tax

Denied

year, beginning July 1.

Briefly give reason for denial

• If you acquire property after March 1 but before July 1, file this form

within 30 days of acquisition.

• If you are a disabled veteran, you must attach your discharge papers (DD–214 or other equivalent documentation) showing your

period of active service and conditions of release or discharge from the military. You must also attach your disability certificate. See

Part 1 of the instructions on page 3 of this form for more information.

• If you are a surviving spouse or registered domestic partner (partner), you must attach proof of marriage/registered domestic

partnership (partnership) to the deceased veteran, the veteran’s death certificate, and the veteran’s military discharge or release papers

(DD–214 or other equivalent documentation). You also cannot have entered into a new marriage or partnership. See Part 2 of the

instructions on page 4 of this form for more information.

• If you are the surviving spouse/partner of a qualified veteran who died during the prior tax year, file this form with the county

assessor any time during the current tax year. See Part 2 of the instructions on page 4 of this form for more information.

• This form is available online on the Department of Revenue’s website at: w ww.oregon.gov/dor/forms.

• If your property is held in a trust, it must be a revocable trust and you must submit the trust documentation.

Claimant Section

I am claiming an exemption for tax year 20__________.

Name of claimant

County where home is located

County account number

Mailing address

City

State

ZIP code

Location of property for which exemption is sought (street address)

City

State

ZIP code

ORS 307.250 allows a portion of the assessed value of your property to be exempt from taxation. You must be an Oregon

resident, own and live in your own home, and it must be your primary residence.

Part 1—Claim for exemption by a qualified disabled veteran

ORS 307.250 grants an exemption to any qualified disabled veteran. You must have been a member of and discharged or

released under honorable conditions from the U.S. Armed Forces. You must have completed a minimum period of active

service. You must also be certified as having disabilities of 40 percent or more. See Part 1 of the instructions on page 3

of this form for more information.

Complete either Section A or B. Check the boxes that apply to you.

A. I am an honorably discharged veteran who is officially certified by the U.S. Department of Veterans Affairs or the

U.S. Armed Forces. You do not have to file every year. If any qualifying conditions change, you must file a new claim

to continue your exemption. See Part 1 of the instructions on page 3 of this form for more information.

1.

I have disabilities of 40 percent or more.

2.

I have service-connected disabilities of 40 percent or more.

3.

I have attached my disability certificate and it is dated within three years of this claim.

4.

I have previously filed my disability certificate and do not need to file it now because I filed it after reaching the

age of 65 or I am certified permanently disabled.

5.

I am filing within six months of the date the federal government notified me of a certified disability rating of 40

percent or more. I may claim up to three prior tax years plus the current tax year. (Note: The earliest year of

exemption is the tax year following the effective date of your certified disability.)

Before you mail your claim form, make sure you:

✔ Complete pages 1 and 2 of the form. ✔ Sign your claim form.

✔ Attach a copy of the required documents.

Mail your claim form and attachments to your county assessor.

150-303-086 (Rev. 01-12)

Disabled Veteran or Surviving Spouse Exemption Claim (Page 1 of 5)

1

1 2

2 3

3 4

4 5

5