Form Edu-96 - State And Local Sales/use Tax Rate Changes

ADVERTISEMENT

Phone: 785-368-8222

915 SW Harrison St

FAX: 785-291-3614

Topeka KS 66625-2007

_________________________________________________________________________________________________________

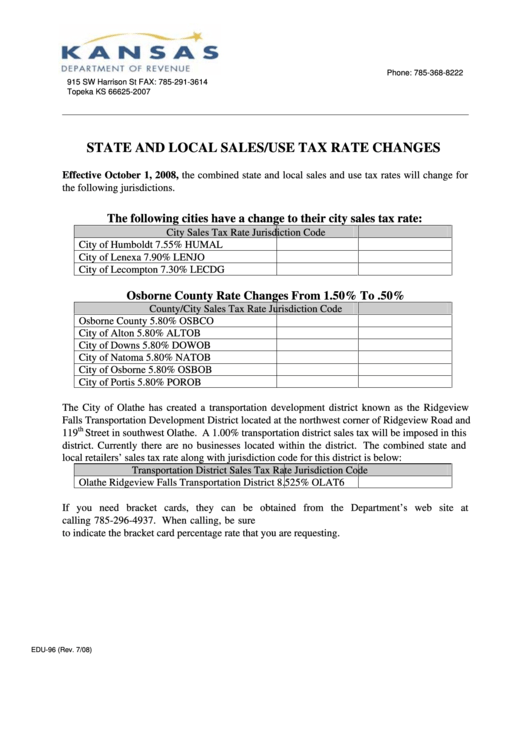

STATE AND LOCAL SALES/USE TAX RATE CHANGES

Effective October 1, 2008, the combined state and local sales and use tax rates will change for

the following jurisdictions.

The following cities have a change to their city sales tax rate:

City

Sales Tax Rate

Jurisdiction Code

City of Humboldt

7.55%

HUMAL

City of Lenexa

7.90%

LENJO

City of Lecompton

7.30%

LECDG

Osborne County Rate Changes From 1.50% To .50%

County/City

Sales Tax Rate

Jurisdiction Code

Osborne County

5.80%

OSBCO

City of Alton

5.80%

ALTOB

City of Downs

5.80%

DOWOB

City of Natoma

5.80%

NATOB

City of Osborne

5.80%

OSBOB

City of Portis

5.80%

POROB

The City of Olathe has created a transportation development district known as the Ridgeview

Falls Transportation Development District located at the northwest corner of Ridgeview Road and

th

119

Street in southwest Olathe. A 1.00% transportation district sales tax will be imposed in this

district. Currently there are no businesses located within the district. The combined state and

local retailers’ sales tax rate along with jurisdiction code for this district is below:

Transportation District

Sales Tax Rate

Jurisdiction Code

Olathe Ridgeview Falls Transportation District

8.525%

OLAT6

If you need bracket cards, they can be obtained from the Department’s web site at

or by calling 785-296-4937. When calling, be sure

to indicate the bracket card percentage rate that you are requesting.

EDU-96 (Rev. 7/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1