Form Rev 81 1008 - Rural County Application For Sales And Use Tax Deferral For Lessor 82.60 Rcw - 2009

ADVERTISEMENT

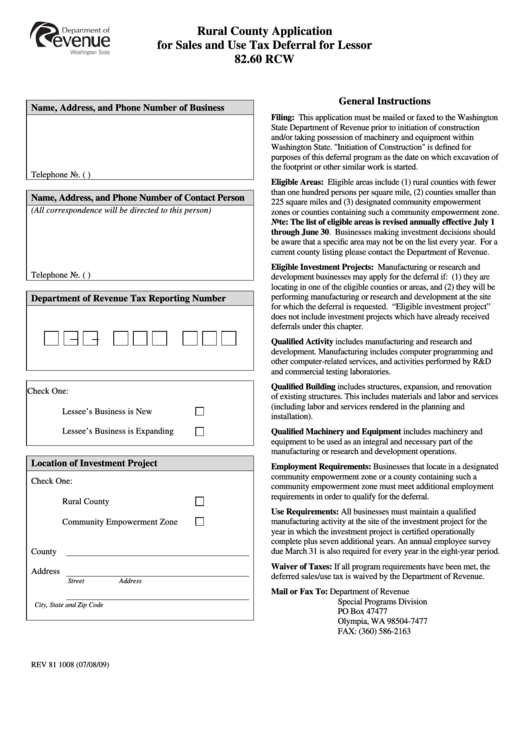

Rural County Application

for Sales and Use Tax Deferral for Lessor

82.60 RCW

General Instructions

Name, Address, and Phone Number of Business

Filing: This application must be mailed or faxed to the Washington

State Department of Revenue prior to initiation of construction

and/or taking possession of machinery and equipment within

Washington State. "Initiation of Construction" is defined for

purposes of this deferral program as the date on which excavation of

the footprint or other similar work is started.

Telephone No. (

)

Eligible Areas: Eligible areas include (1) rural counties with fewer

than one hundred persons per square mile, (2) counties smaller than

Name, Address, and Phone Number of Contact Person

225 square miles and (3) designated community empowerment

(All correspondence will be directed to this person)

zones or counties containing such a community empowerment zone.

Note: The list of eligible areas is revised annually effective July 1

through June 30. Businesses making investment decisions should

be aware that a specific area may not be on the list every year. For a

current county listing please contact the Department of Revenue.

Eligible Investment Projects: Manufacturing or research and

Telephone No. (

)

development businesses may apply for the deferral if: (1) they are

locating in one of the eligible counties or areas, and (2) they will be

performing manufacturing or research and development at the site

Department of Revenue Tax Reporting Number

for which the deferral is requested. “Eligible investment project”

does not include investment projects which have already received

deferrals under this chapter.

−

−

Qualified Activity includes manufacturing and research and

development. Manufacturing includes computer programming and

other computer-related services, and activities performed by R&D

and commercial testing laboratories.

Qualified Building includes structures, expansion, and renovation

Check One:

of existing structures. This includes materials and labor and services

(including labor and services rendered in the planning and

Lessee’s Business is New

installation).

Lessee’s Business is Expanding

Qualified Machinery and Equipment includes machinery and

equipment to be used as an integral and necessary part of the

manufacturing or research and development operations.

Location of Investment Project

Employment Requirements: Businesses that locate in a designated

community empowerment zone or a county containing such a

Check One:

community empowerment zone must meet additional employment

requirements in order to qualify for the deferral.

Rural County

Use Requirements: All businesses must maintain a qualified

Community Empowerment Zone

manufacturing activity at the site of the investment project for the

year in which the investment project is certified operationally

complete plus seven additional years. An annual employee survey

County

due March 31 is also required for every year in the eight-year period.

Waiver of Taxes: If all program requirements have been met, the

Address

deferred sales/use tax is waived by the Department of Revenue.

Street Address

Mail or Fax To:

Department of Revenue

Special Programs Division

City, State and Zip Code

PO Box 47477

Olympia, WA 98504-7477

FAX: (360) 586-2163

REV 81 1008 (07/08/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3