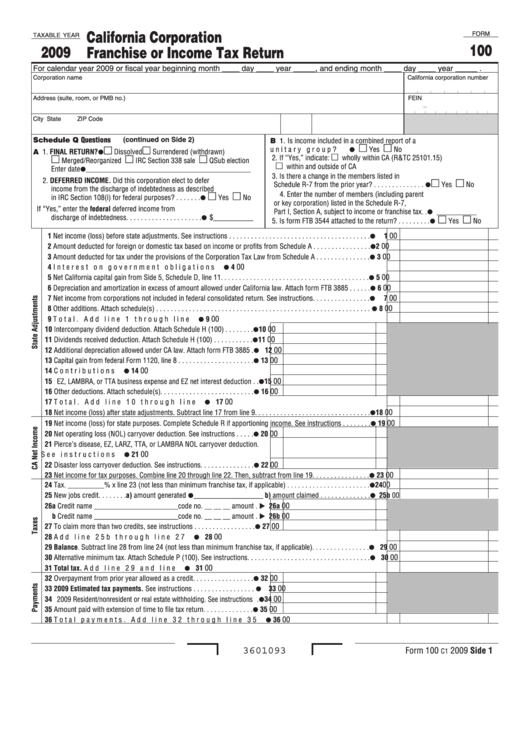

California Corporation

FORM

TAXABLE YEAR

100

2009

Franchise or Income Tax Return

For calendar year 2009 or fiscal year beginning month ____ day ____ year _____, and ending month ____ day ____ year _____ .

Corporation name

California corporation number

Address (suite, room, or PMB no.)

FEIN

-

City

State

ZIP Code

Schedule Q Questions

(continued on Side 2)

B 1. Is income included in a combined report of a

unitary group?

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

A 1. FINAl reTurN?

Dissolved

Surrendered (withdrawn)

2. If “Yes,” indicate:

wholly within CA (R&TC 25101.15)

Merged/Reorganized

IRC Section 338 sale

QSub election

within and outside of CA

Enter date

_________________________________________

3. Is there a change in the members listed in

2. DeFerreD INCOMe. Did this corporation elect to defer

Schedule R-7 from the prior year? . . . . . . . . . . . . . .

Yes

No

income from the discharge of indebtedness as described

4. Enter the number of members (including parent

in IRC Section 108(i) for federal purposes? . . . . . . .

Yes

No

or key corporation) listed in the Schedule R-7,

If “Yes,” enter the federal deferred income from

Part I, Section A, subject to income or franchise tax . .

___________

discharge of indebtedness. . . . . . . . . . . . . . . . . . . . .

$___________

5. Is form FTB 3544 attached to the return? . . . . . . . . .

Yes

No

� Net income (loss) before state adjustments. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

00

00

2 Amount deducted for foreign or domestic tax based on income or profits from Schedule A . . . . . . . . . . . . . . . .

2

00

3 Amount deducted for tax under the provisions of the Corporation Tax Law from Schedule A . . . . . . . . . . . . . . .

3

00

4 Interest on government obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Net California capital gain from Side 5, Schedule D, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Depreciation and amortization in excess of amount allowed under California law. Attach form FTB 3885 . . . . . .

6

00

7 Net income from corporations not included in federal consolidated return. See instructions. . . . . . . . . . . . . . . .

7

8 Other additions. Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

00

9 Total. Add line 1 through line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

�0 Intercompany dividend deduction. Attach Schedule H (100) . . . . . . . .

�0

�� Dividends received deduction. Attach Schedule H (100) . . . . . . . . . . .

��

00

00

�2 Additional depreciation allowed under CA law. Attach form FTB 3885 .

�2

00

�3 Capital gain from federal Form 1120, line 8 . . . . . . . . . . . . . . . . . . . . .

�3

00

�4 Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�4

00

�5 EZ, LAMBRA, or TTA business expense and EZ net interest deduction. .

�5

00

�6 Other deductions. Attach schedule(s). . . . . . . . . . . . . . . . . . . . . . . . . .

�6

00

�7 Total. Add line 10 through line 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�7

00

�8 Net income (loss) after state adjustments. Subtract line 17 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�8

00

�9 Net income (loss) for state purposes. Complete Schedule R if apportioning income. See instructions . . . . . . . .

�9

00

20 Net operating loss (NOL) carryover deduction. See instructions . . . . .

20

2� Pierce’s disease, EZ, LARZ, TTA, or LAMBRA NOL carryover deduction.

00

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2�

00

22 Disaster loss carryover deduction. See instructions. . . . . . . . . . . . . . .

22

23 Net income for tax purposes. Combine line 20 through line 22. Then, subtract from line 19 . . . . . . . . . . . . . . . .

23

00

00

24 Tax. __________% x line 23 (not less than minimum franchise tax, if applicable) . . . . . . . . . . . . . . . . . . . . . . .

24

25 New jobs credit. . . . . . . . a) amount generated

___________________ b) amount claimed . . . . . . . . . . . . . .

25b

00

26a Credit name _______________________code no. __ __ __ amount . 26a

00

00

b Credit name _______________________code no. __ __ __ amount . 26b

00

27 To claim more than two credits, see instructions . . . . . . . . . . . . . . . . .

27

00

28 Add line 25b through line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29 Balance. Subtract line 28 from line 24 (not less than minimum franchise tax, if applicable) . . . . . . . . . . . . . . . .

29

00

00

30 Alternative minimum tax. Attach Schedule P (100). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

00

3� Total tax. Add line 29 and line 30. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3�

32 Overpayment from prior year allowed as a credit . . . . . . . . . . . . . . . . .

32

00

00

33 2009 estimated tax payments. See instructions . . . . . . . . . . . . . . . . .

33

00

34 2009 Resident/nonresident or real estate withholding. See instructions .

34

00

35 Amount paid with extension of time to file tax return . . . . . . . . . . . . . .

35

00

36 Total payments. Add line 32 through line 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

Form 100

2009 Side �

3601093

C1

1

1 2

2 3

3 4

4 5

5