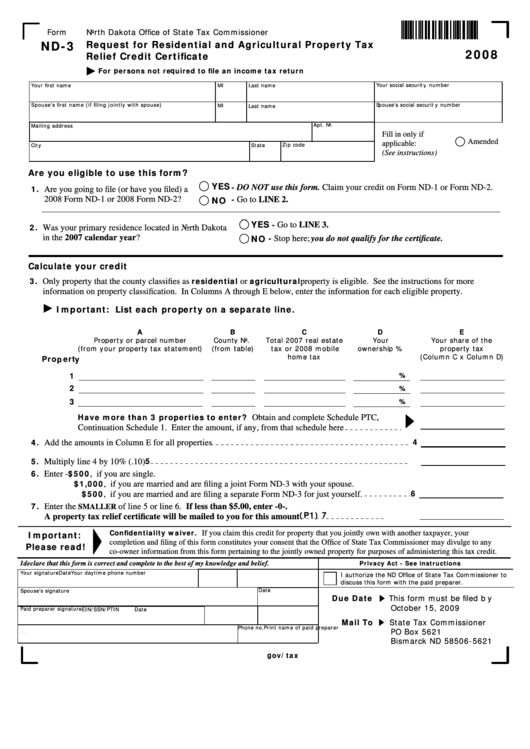

Form

North Dakota Office of State Tax Commissioner

ND-3

Request for Residential and Agricultural Property Tax

2008

Relief Credit Certificate

For persons not required to file an income tax return

Your first name

MI

Last name

Your social security number

Spouse's first name (if filing jointly with spouse)

Spouse's social security number

MI

Last name

Apt. No.

Mailing address

Fill in only if

Amended

applicable:

Zip code

City

State

(See instructions)

Are you eligible to use this form?

YES

1.

- DO NOT use this form. Claim your credit on Form ND-1 or Form ND-2.

Are you going to file (or have you filed) a

NO

2008 Form ND-1 or 2008 Form ND-2?

- Go to LINE 2.

YES

- Go to LINE 3.

2.

Was your primary residence located in North Dakota

NO

in the 2007 calendar year?

- Stop here; you do not qualify for the certificate.

Calculate your credit

3.

residential

agricultural

Only property that the county classifies as

or

property is eligible. See the instructions for more

information on property classification. In Columns A through E below, enter the information for each eligible property.

Important: List each property on a separate line.

A

B

C

D

E

Property or parcel number

County No.

Total 2007 real estate

Your

Your share of the

(from your property tax statement)

(from table)

tax or 2008 mobile

ownership %

property tax

home tax

(Column C x Column D)

Property

1

%

2

%

3

%

Have more than 3 properties to enter?

Obtain and complete Schedule PTC,

Continuation Schedule 1. Enter the amount, if any, from that schedule here

4

4.

Add the amounts in Column E for all properties

5.

5

Multiply line 4 by 10% (.10)

6.

$500

Enter -

, if you are single.

$1,000

, if you are married and are filing a joint Form ND-3 with your spouse.

6

$500

, if you are married and are filing a separate Form ND-3 for just yourself.

7.

Enter the

of line 5 or line 6. If less than $5.00, enter -0-.

SMALLER

(P1) 7

A property tax relief certificate will be mailed to you for this amount

Confidentiality waiver.

Important:

If you claim this credit for property that you jointly own with another taxpayer, your

completion and filing of this form constitutes your consent that the Office of State Tax Commissioner may divulge to any

Please read!

co-owner information from this form pertaining to the jointly owned property for purposes of administering this tax credit.

Privacy Act - See instructions

I declare that this form is correct and complete to the best of my knowledge and belief.

Your signature

Date

Your daytime phone number

I authorize the ND Office of State Tax Commissioner to

discuss this form with the paid preparer.

Date

Spouse's signature

ND-2

Due Date

This form must be filed by

October 15, 2009

Paid preparer signature

EIN/SSN/PTIN

Date

Mail To

State Tax Commissioner

Print name of paid preparer

Phone no.

PO Box 5621

i

t

Bismarck ND 58506-5621

1

1